In April of 2020, Fund That Flip launched the Residential Bridge Note Fund, commonly known as “RBNF.” The fund allows accredited investors to invest in different tranches with unique terms in the form of Series Notes. These individual Series Notes are combined to form a larger diversified fund which invests into individual loans originated on the Fund That Flip platform via Borrower Dependent Notes (BDN’s). The fund has proved to be highly popular, with each Series Note offering filling quickly. Some benefits to diversifying your portfolio with an investment in Fund That Flip’s RBNF can be found below:

- Diversification - A single investment is spread across multiple whole and fractional loans throughout our platform.

- Fixed Maturity - Each note has a fixed maturity date, giving certainty to principal repayment.

- Passive - Investments are selected by the fund manager which alleviates the need for investors to assess and select each investment.

- Utilization - The investment earns interest from the day investment funds clear escrow.

- FTF alignment - Fund That Flip will contribute 10% of the outstanding capital raised, up to $1M, to demonstrate our aligned incentives.

At the end of 2020, RBNF had successfully issued and raised $5.06 million across 11 different Series Notes. More specifically, in 2020 Q4, RBNF successfully issued and raised three Series Notes, totaling $1.5 million. Looking at total deployment and repayment at the end of 2020, RBNF had deployed $5.68 million across 239 assets and had 68 assets repay for $1.89 million.

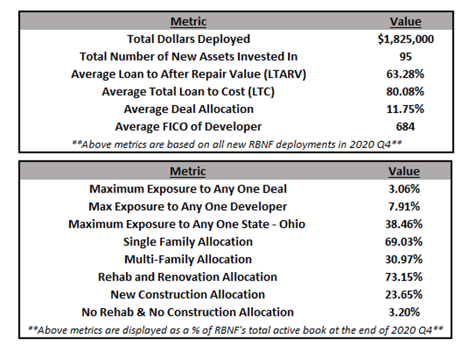

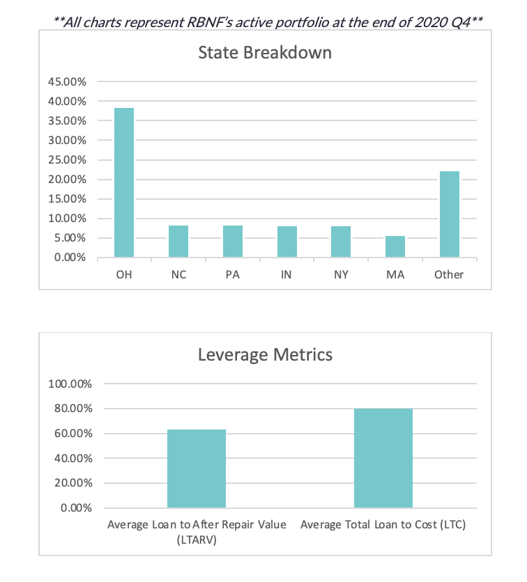

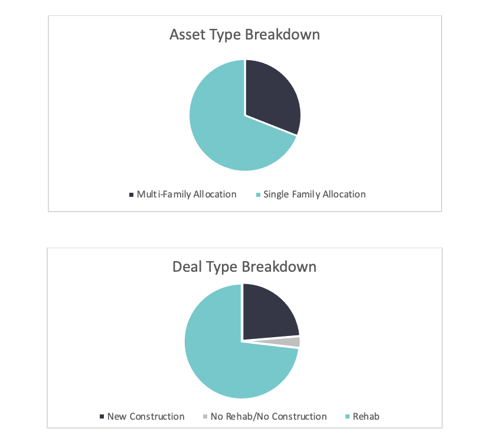

In order to closely monitor diversification and concentration, the fund has a set of underlying investment criteria which are used to guide investment decisions in relation to geographical locations, borrowers, and asset types. To illustrate this clearly, below are some key performance metrics that demonstrate the diversity of new RBNF deployment in 2020 Q4, as well as active portfolio metrics at the end of 2020 Q4.

RBNF Performance data 2020 Q4:

Performance Charts:

In the coming weeks and months, we will be issuing further RBNF Series Notes with varying maturity dates. In line with the underlying risk strategy, Series Notes with longer maturities will have higher rates of return for investors.

Our forward-looking objective is to release new Series Notes on a regular basis to provide our investors with the opportunity to regularly invest in our newest investment vehicle.

Also, for those who may have already invested in an RBNF Series Note, be sure to check out our new rollover feature. This feature will allow you to take your current RBNF investment that is set to mature and roll it over into the next RBNF series that will be offered without missing any days of interest.

Stay tuned to our blog to see our updated RBNF performance report for 2021 Q1 in April.

Ready to start investing? Click below to browse through our open offerings of RBNF as well as other series note offerings and BDN's:

Click below to sign up for advanced notice and access to exclusive information on RBNF:

If you'd like more information on the fund, or about investing with Fund That Flip in general, please reach out to us at investorrelations@fundthatflip.com.