The 2Q23 (April 1 – June 30, 2023) Investor Report for the Horizon Residential Income Fund I, LLC.

Table of Contents (click to go to that section)

- Introduction

- Company Overview

- Horizon Residential Income Fund I, LLC (HRIF)

- What is HRIF?

- Investment Strategy

- Key Highlights and Achievements

- Schedule of Investments

- Portfolio Composition and Risk Management

- Financial Performance

- Outlook

- Investment Commitee

- Success Story

- Contact

Introduction

In April 2023, Fund That Flip unveiled its latest investment offering: the Horizon Residential Income Fund I, LLC, referred to henceforth as HRIF or simply the "Fund." HRIF was conceived to offer passive investors an additional avenue to access the flourishing U.S. real estate market, providing an additional opportunity for accredited investors to enter the Residential Transition Loans (RTL) asset class.

Through the Fund, we are now able to offer investors the added benefits of leverage and distinctive tax advantages. The primary objectives of HRIF are to diversify portfolios and generate steady income streams for its members. In the second quarter of 2023, HRIF’s Fund Managers and Investment Committee evaluated more than 100 properties across the eastern U.S. to identify optimal opportunities for portfolio growth.

Today, the HRIF team is delighted to present the inaugural Quarterly Investor Report. This report provides members with a comprehensive overview of HRIF's investment strategy, the composition of its portfolio, financial performance in the second quarter of 2023, and an outlook for the latter half of the year.

Company Overview: Fund That Flip

Established in 2014, Fund That Flip embarked on a mission to establish itself as the preeminent technological real estate investment platform, empowering both active and passive investors to create wealth and improve communities through real estate. The Fund That Flip team has since successfully originated more than$2.6B in short-term residential mortgages throughout 36 states. Distinguished by a rigorous underwriting process that is continuously refined to adapt to changing economic and market conditions, Fund That Flip's portfolio consistently surpasses industry benchmarks from both a risk mitigation and principal recovery perspective.

Since its inception, Fund That Flip has successfully connected active real estate developers to capital from passive investors. Prior to the advent of Fund That Flip, developers often encountered formidable obstacles in accessing funding for short-term construction projects beyond the confines of conventional bank financing and private funding channels. Through Fund That Flip’s Borrower Dependent Notes (BDNs), passive real estate investors have been able to purchase fractional ownership of the mortgages originated by Fund That Flip. While BDNs afford passive investors the latitude to scrutinize and evaluate individual underlying assets across diverse markets, the onus of conducting this meticulous analysis one by one is not always optimal for these stakeholders. Seeking to address these drawbacks, Fund That Flip introduced the Horizon Residential Income Fund, thereby granting investors access to a diversified portfolio with markedly less effort. With a wealth of industry acumen, the HRIF team ensures investors can rest assured in the knowledge that their capital is being deployed into assets facilitated, underwritten, and serviced by the Fund That Flip team.

Horizon Residential Income Fund I, LLC

What is the Horizon Residential Income Fund?

The Horizon Residential Income Fund I, LLC (HRIF) is an investment vehicle specializing in short-term, first-lien mortgage loans against residential properties throughout the Eastern U.S., and underwritten and originated exclusively by Fund That Flip. HRIF is meticulously crafted to furnish its members with a trifecta of advantages: an ongoing stream of current income at a fair risk-adjusted return and amplified through leverage, a diversified portfolio, and the substantial tax advantages made available through its sub-REIT structure. By embracing an investment opportunity in HRIF, individuals are poised to gain passive exposure to residential real estate assets dispersed across diverse geographical landscapes and markets. In doing so, HRIF contributes to alleviating the housing scarcity prevalent in the United States while also uplifting local communities.

Horizon Residential Income Fund I Investment Strategy

Through the purchase of short-term residential bridge mortgages, HRIF is pursuing an 8% preferred return per annum, with a target return between 10%–13%. The Fund is subject to a 1% management fee of HRIF’s monthly net asset value. Any earnings surpassing the 8% preferred return threshold will result in a 20% carry for the manager, with the remaining 80% directed back to the HRIF membership. It is important to note that a waiver or reduction of accrued management fees and carry will be evaluated monthly if an 8% preferred return is not attained.

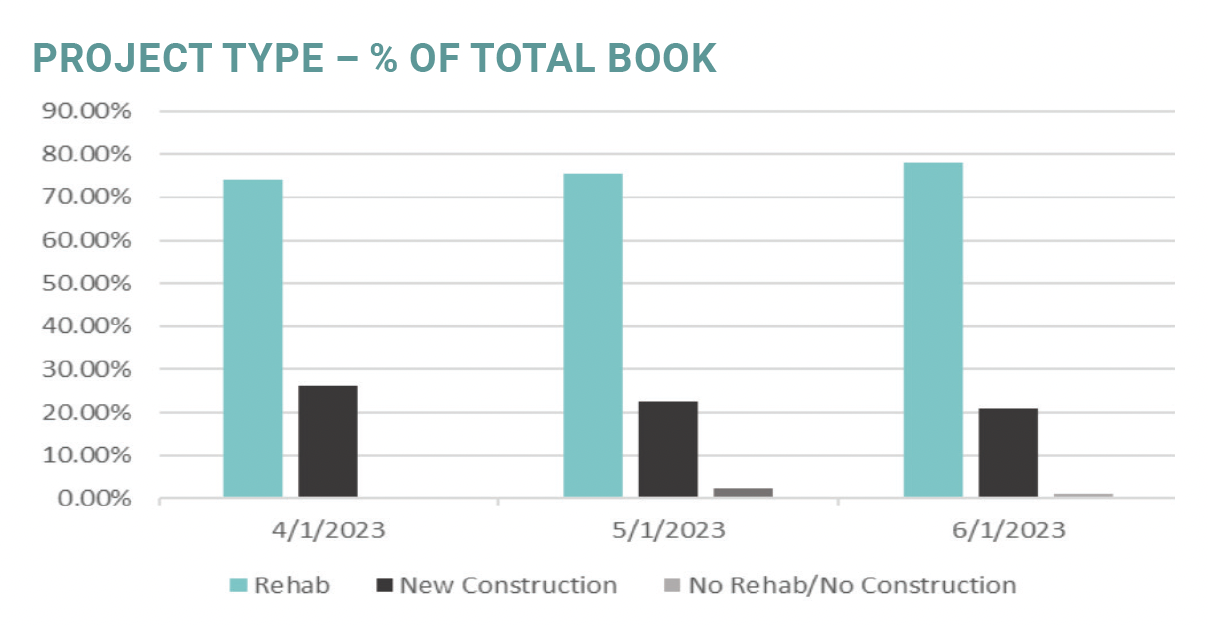

While committed to maximizing returns, the HRIF team will prioritize adherence to stringent investment directives designed to manage and alleviate portfolio risk. The composition of HRIF’s portfolio will consist of a blended balance of rehab, new construction, and land assets that can vary between single-family and multi-family assets. The mortgages purchased will be predominantly located in the eastern United States, with emphasis on key metropolitan areas within the Ohio Valley region, the Carolinas, the Southeast (Florida, Georgia, Alabama), and Texas. HRIF leadership identifies need for an increased housing supply to keep up with demand within these markets, mainly due to total household growth outpacing new housing starts, an aging housing stock, economic expansion, and population growth.

HRIF will also target mortgages structured with a Dutch interest component, as opposed to Non-Dutch. Dutch interest loans enable HRIF to accrue interest on the gross loan amount from the outset, regardless of whether the total principal balance has been fully disbursed to the developer.

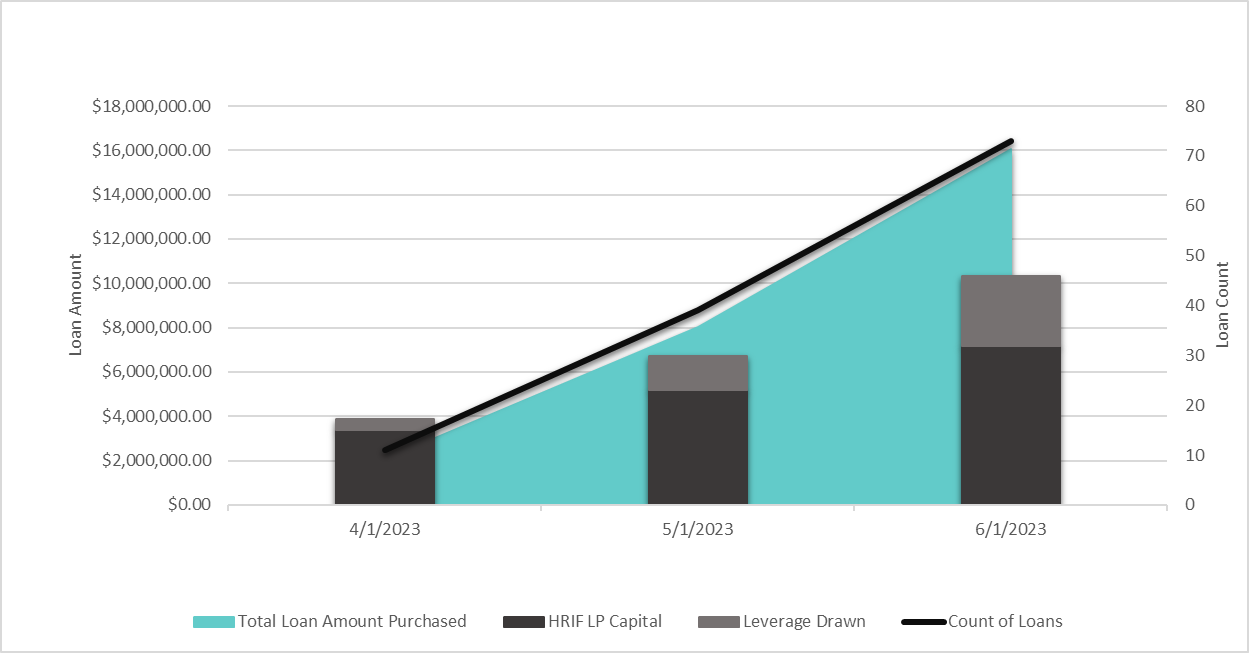

In pursuit of heightened returns and diversified portfolio holdings, HRIF will employ conventional leveraged financing. This approach grants HRIF the capacity to secure leverage of up to four times the cumulative equity amassed. The mortgages purchased through equity investments will subsequently serve as collateral, against which HRIF can secure supplementary debt from its financing partner(s). This is vital to HRIF’s overall performance as it will allow for more loans to be purchased, increasing the overall principal balance that is actively earning interest, thereby elevating HRIF's overall returns and increasing portfolio diversification.

Key Highlights and Achievements in 2Q23

With the launch of any new product offering, there are several obstacles that must be navigated quickly and precisely to achieve success. Below are major highlights that took place during the first quarter of HRIF’s operations:

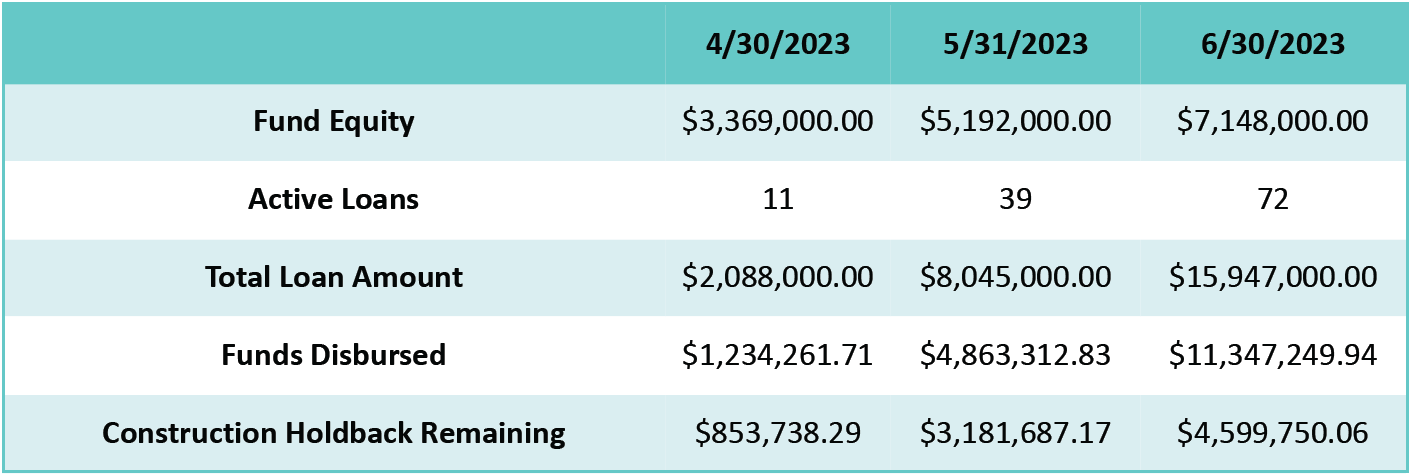

- The Fund successfully raised $7.148M of new equity from seed investors.

- HRIF’s first loan pool was purchased on April 3, 2023. This pool consisted of 11 mortgages totaling $2.088M.

- Throughout the quarter, HRIF purchased 73 mortgages totaling $16.080M.

- HRIF disbursed 112 construction draws to developers for home improvements, totaling $3.185M.

- HRIF saw its first loan repayment in June 2023. The developer successfully completed and exited the project in only 66 days.

- The Fund had a delinquency rate of 0%, as all interest payments were made on time by developers.

Schedule of Investments

At the launch of the Fund in April 2023, after an investment window of less than two weeks, HRIF accumulated $3.369M in equity investments from its first group of seed investors. HRIF’s team was able to deploy a portion of the new equity investments in April and purchased its first pool of mortgages from Fund That Flip on April 3, 2023. After passing on a number of mortgages that would have concentrated too high a risk to a single developer and market, the first pool of purchased loans consisted of eleven mortgages for a total loan amount of $2.088M. This pool was primarily focused on single-family, low-rehab projects across eleven metropolitan areas and eleven unique developers. Additionally, the HRIF team was able to pledge these mortgages to its partnering credit facility at the end of April, which allowed the Fund to gain additional capital prior to May.

In May 2023, HRIF received new equity investments totaling $1.823M and took on additional leverage from its credit facility. With the influx of cash from May equity investments, along with equity and leveraged dollars that remained undeployed at the end of April, HRIF was able to more than double its mortgages purchased.. In May, HRIF purchased an additional 28 loans, which brought the total portfolio to 39 individual assets held for $8.045M. These mortgages were predominantly located in Florida, Ohio, North Carolina, Indiana, and Georgia, with ~87% of the portfolio being single-family assets, ~8% being two-family assets, and the remainder being three or more units.

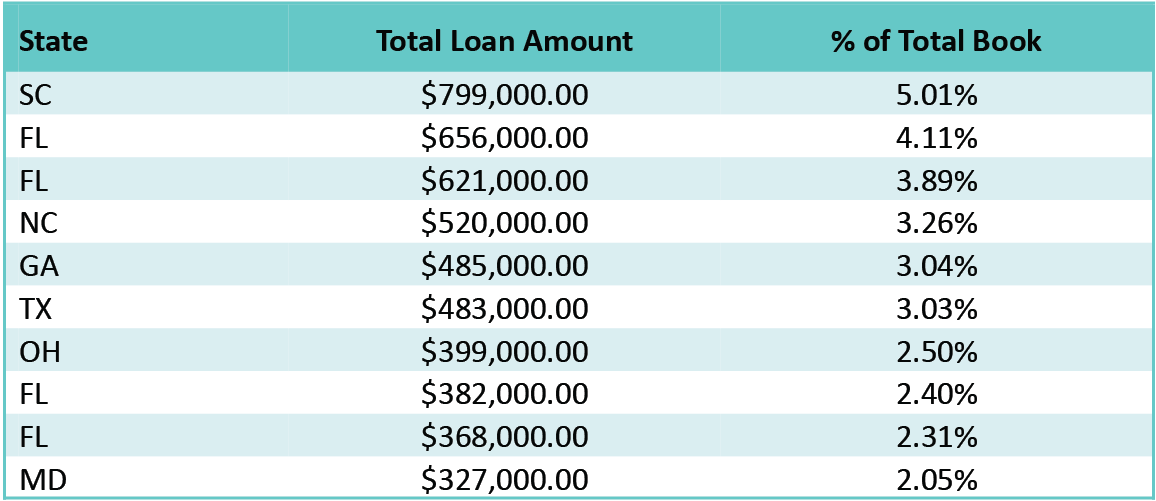

For the final month of the quarter, HRIF received an additional $1.906M in equity investments, bringing the Fund’s total equity to $7.148M. Also in June, HRIF purchased 34 additional mortgages and had its first loan repay. This brought the active portfolio at the end of 2Q23 to 72 active mortgages for a total loan amount of $15.947M. June’s new investment activity also shifted the portfolio’s main geographic concentrations to Ohio, Florida, South Carolina, North Carolina, and Indiana, with ~92% of the portfolio being single-family assets.

A further breakdown of HRIF’s 2Q23 investment schedule can be found below:

HRIF MONTHLY EQUITY ADMITTANCE & CAPITAL DEPLOYMENT

Portfolio Composition and Risk Management

When looking at portfolio composition and risk management for HRIF, the main portfolio metrics the HRIF team considers are:

- Geographic Location

- State and MSA (by gross loan and outstanding principal)

- Weighted Average Leverage Metrics

- Loan to As-Is Value (LTAIV)

- Loan to Cost (LTC)

- Loan to After Repair Value (LTARV)

- Project Type

- Rehab

- New Construction

- No Rehab/No Construction

- Individual Deal Exposure Relative to Total Book Size

- Individual Developer Exposure Relative to Total Book Size

- Developer Creditworthiness

- Credit score

- Current liquidity

- Previous project experience

- Project viability, profitability and exit strategy

We monitor these different metrics to ensure we are maintaining a balanced portfolio that aligns with our overall investment strategies. To help mitigate risk to the Fund, the team is constantly evaluating changes to our weighted portfolio metrics as new loans are purchased and previously held assets are repaid to ensure that our portfolio composition remains aligned with set benchmarks.

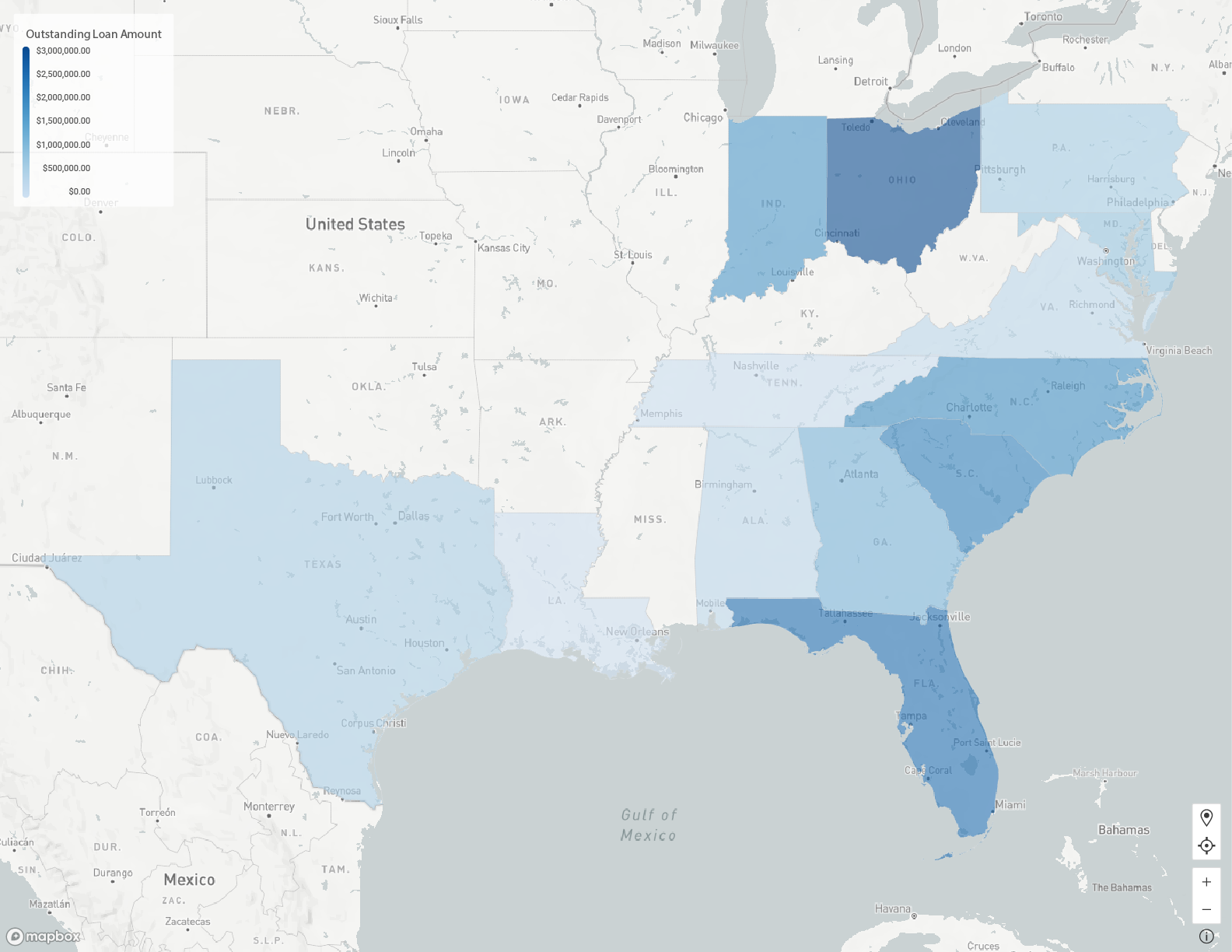

First looking at the portfolio's geographic concentration, HRIF has a set max exposure to any one state at 20%. Additionally, HRIF looks to keep any given MSA to a concentration below 8%. In April, HRIF’s portfolio's top three geographic regions were Indiana (33.67%), North Carolina (31.61%), and Tennessee (9.77%). While April’s geographic concentrations exceeded our maximum target of 20%, this was expected for the first month as we worked to build the overall portfolio size.

Looking into May, the top three geographic regions then shifted to Florida (17.48% ), Ohio (16.03%), and North Carolina (14.85%). Below is a breakdown of the Fund’s end of Q2 portfolio exposure across all states.

As seasons change and markets adjust, we will continue to closely monitor our shifts in geographic concentrations to ensure the portfolio is properly positioned.

HRIF STATE EXPOSURE – % TOTAL PORTFOLIO AS OF 06/30/2023

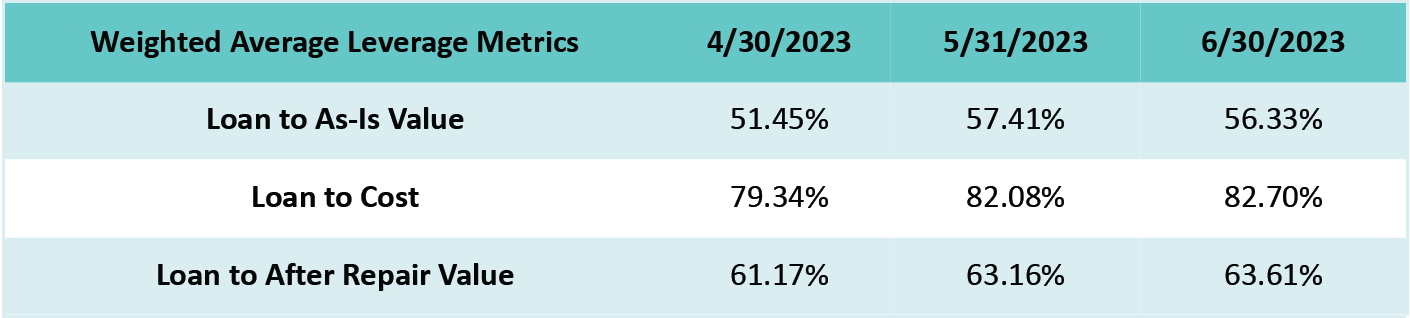

HRIF’s loan leverage metrics are also a vital piece to the portfolio's overall health. These leverage ratios are what protect each loan against any unforeseen downside risk. Below is a quick breakdown on the importance of each:

- Loan to As-Is Value (LTAIV): LTAIV looks at HRIF’s day-one exposure to any given loan and ensures each developer has substantial equity in each property from day one. We have set a maximum LTAIV constraint per loan of 70%, and are targeting a portfolio below 65% LTAIV.

- Loan to Cost (LTC): LTC looks at the total costs of the project (Purchase Price Plus Construction Costs) relative to the total loan amount. HRIF wants to see that the total costs of the project exceed the total loan amount by at least 10% to ensure the developer has equity in the project and aligned interests. We have set a maximum LTC constraint for any loan within the portfolio at 90%, while targeting a portfolio makeup below 85%.

- Loan to After Repair Value (LTARV): LTARV compares the total loan amount to the final expected value of the property after all renovations have been completed. If a developer sells a completed property below market value, or if there is any home price depreciation during the time to complete the project, HRIF wants to ensure there is enough margin at a lower price to still return full principal from sale or refinance proceeds. The HRIF team has set a maximum LTARV constraint for each loan and the entire portfolio at 70%.

In the below table, HRIF’s month-over-month changes in WAVG Loan Leverage Metrics are presented. Each metric was held well below our targeted maximum leverage ratios.

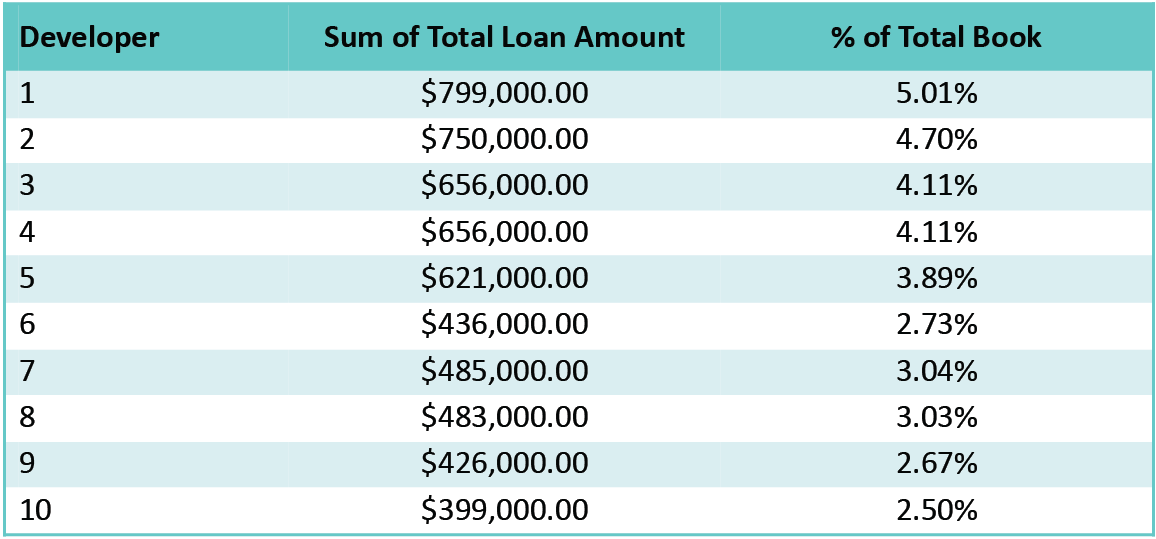

TOP 10 LOANS – % TOTAL OF BOOK (06/30/2023)

TOP 10 DEVELOPERS – % OF TOTAL BOOK (06/30/2023)

Financial Performance

Since inception, HRIF's objective has been twofold: to introduce a novel product that not only amplifies portfolio diversification for its members but also generates a new avenue for wealth via quarterly income from an alternative asset class. For HRIF's members, the Fund aspired to attain an annualized preferred return of 8%, while targeting annualized returns ranging between 10%–13%.

An inherent challenge encountered by all nascent funds involves striking a balance between the prudent deployment of capital to generate income and the immediate onset of monthly expenditures.

As mentioned in the Scheduled Investments section of the report, we were able to deploy capital early in the first month of existence. However, while the team worked to optimize portfolio makeup, as well as processes for loan review and purchase, a portion of April’s equity was not fully deployed, negatively impacting April returns. While HRIF was able to earn more than $13K in interest income in April, professional fees, interest expense, loan servicing fees, and loan fees on HRIF’s credit facility had a significant impact on net operating income. Additionally, HRIF owed a 1% management fee to its managing entity that further reduced April’s net income.

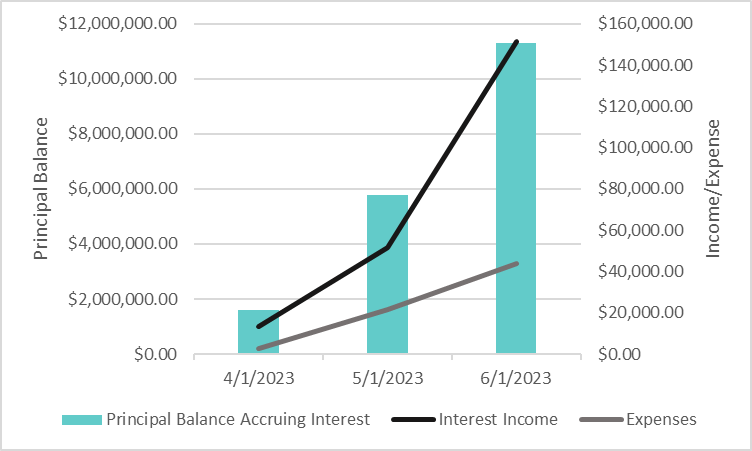

In May and June, additional capital was deployed at a rate that steadily outpaced capital deployment in April. During this time, HRIF saw its interest income more than double at an increased rate of 282% from April to May and 194% from May to June. HRIF’s interest income for May and June amounted to more than $38,000 and $100,000, respectively. This increase in HRIF’s interest income steadily outpaced the increase in professional fees and interest expense seen in May and June.

In the table below, a significant upward trend in HRIF’s interest income compared to straight-line fixed expenses is evident.

HRIF INTEREST ACCRUING BALANCE vs. INTEREST INCOME vs. EXPENSE

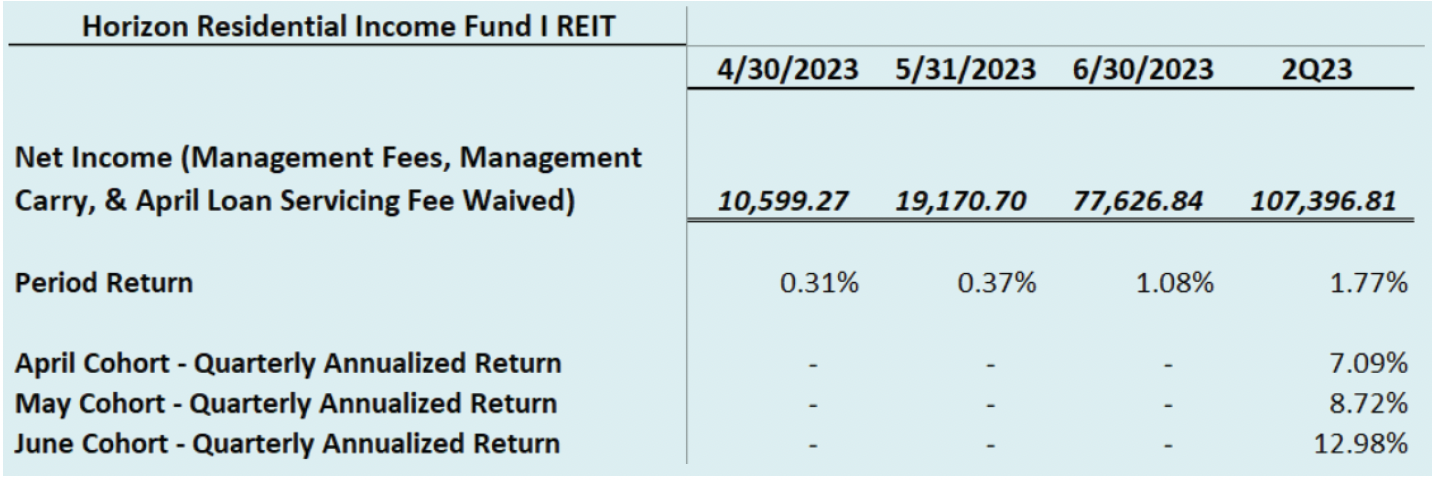

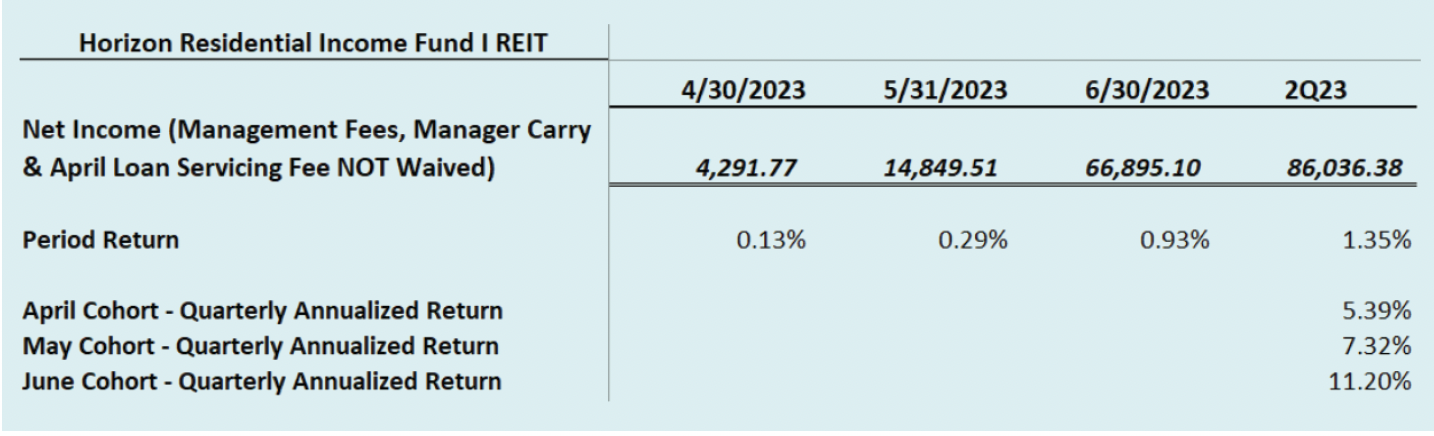

Due to the extended period required for HRIF to scale up its capital deployment, returns in both April and May fell below the initially anticipated targets. Nevertheless, as HRIF achieved a consistent phase of capital deployment by the latter part of May and throughout June, the returns for June markedly exceeded the 8% preferred return threshold. In a bid to alleviate the initial setup costs and counteract the slower capital deployment in the initial two months, the manager took the decision to forgo its 1% fee for the months of April, May, and June. Furthermore, the manager also opted to waive the additional 20% carry on income earned beyond the preferred return during this period. While it is anticipated these fee waivers may not be extended to subsequent months, HRIF's team believed that such a step was most advantageous for both the Fund and its members during the initial quarter of operation.

Below you can find full details surrounding HRIF’s final net income and monthly and quarterly returns after all management fees and carry have been waived. Additionally, the second figure will display Net Income and monthly and quarterly returns if management fees and carry were not waived.

1. Management Fees, Carry and April Professional Fee WAIVED by Manager

*Please note the below results are HRIF’s ACTUAL figures used to calculate each member's monthly and quarterly returns.

2. Management Fees, Carry and April Professional Fee NOT WAIVED by Manager

*Please note that the below results are NOT actual monthly and quarterly returns and are shown to represent monthly and quarterly returns if Manager fees were not waived. Results are not indicative of future month-over-month and quarterly results.

Horizon Residential Income Fund I Outlook

Looking forward to Q3 and Q4 of 2023, HRIF will continue to execute its investment strategy of purchasing short-term residential RTL mortgages underpinned by a steadfast commitment to preserving a portfolio that aligns with designated risk mitigation benchmarks. While HRIF’s portfolio concentration predominantly centered on the Ohio Valley region, the Carolinas, and the Southeast, we envision a continuity of this geographic focus. The HRIF team is confident that these markets are poised for sustained growth, thereby presenting opportunities for HRIF to expand its portfolio. Within these promising markets, we will continue to identify viable projects executed by creditworthy, seasoned developers.

At the close of the second quarter, HRIF’s average loan size was $220,000, with its largest loan amounting to $799,000. The HRIF team does expect this average loan size to increase as we actively explore opportunities to acquire larger mortgages, entailing heightened exposure to mid-luxury, portfolio, and/or multi-family assets. Moreover, HRIF is committed to bolstering its exposure to new construction assets, aiming to cultivate a more balanced portfolio structure. The HRIF team exhibits a strong optimism for new construction, as these projects are typically pursued by more experienced operators and pose reduced execution risk. However, as the portfolio’s new construction exposure grows, the team will judiciously ensure that HRIF remains insulated against an overabundance of nascent new construction projects. This measure is strategically undertaken to curtail HRIF's vulnerability to underdeveloped land, ensuring a measured and prudent approach to portfolio risk management.

From a financial performance perspective, the HRIF team expects to meet and exceed the stated Preferred return of 8% each month. While monthly management fees and carry will likely not be waived moving forward, the HRIF team still expects to reach its monthly targeted annualized return of 10%–13%. Other income sources could potentially be added as the portfolio matures and HRIF collects revenue from late fees, marginal, and penalty interest as well as term extension fees.

Additionally, HRIF will continue to increase the portfolio's buying power as it draws leverage from its partnering credit facility. This will help amplify portfolio returns as the Fund will be able to continue purchasing new loans and increase its interest-accruing balance even after all equity has been deployed.

Other Relevant Information

HRIF is excited to announce the appointment of its newest Investment Committee member, Alex Goodwin. Alex will be replacing Rich Rein as the third member of the committee, joining current members Matt Rodak (CEO) and Linda Yeh (CRCO).

Alex is the Chief Financial Officer (CFO) of Fund That Flip and FTF Capital Management, where he oversees the Finance and Accounting departments. Alex has more than ten years’ experience working in finance and accounting roles within the real estate, financial services, and government sectors. In addition, he is a military veteran, having served over four years as an Officer in the United States Marine Corps. Alex is a licensed Certified Public Accountant (CPA) and active real estate investor. He holds both a Master of Accounting from the University of Southern California (USC) and MBA from University of California, Los Angeles (UCLA). Alex's wealth of prior experiences and deep industry insights will significantly enhance the oversight of HRIF's portfolio and inform our management decision-making process.

Success Story

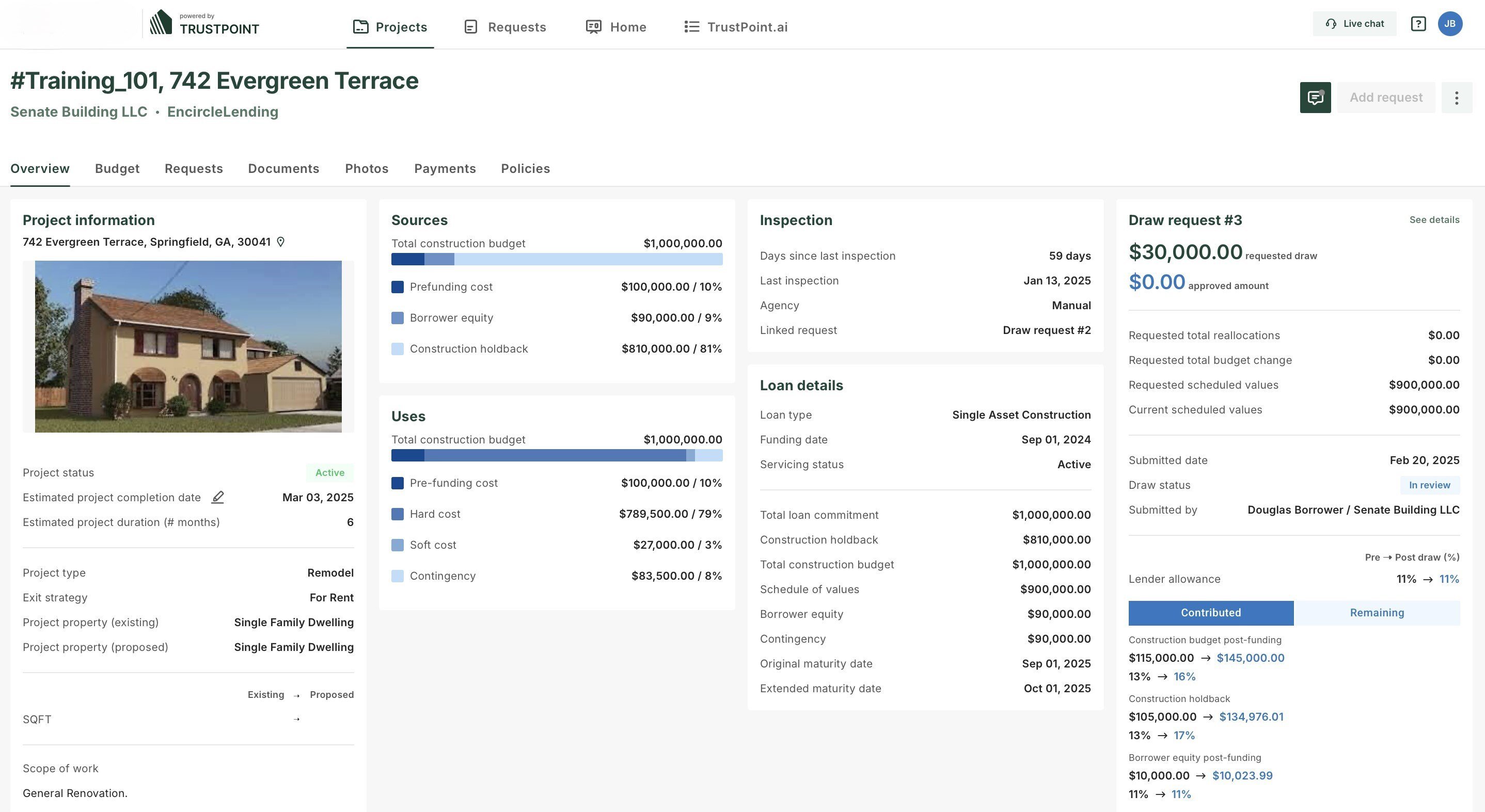

Before purchasing any new mortgage into HRIF, the team follows a stringent diligence process to ensure that all new deals are a proper fit for the Fund. When analyzing any new loan, HRIF’s team ensures that the developer has quality experience with projects of like-kind that have recently been completed and exited, strong credit, and high cash reserves in the event any unforeseen issues arise. Furthermore, we diligently assess leverage metrics for each deal, employing an independent appraiser’s comparables analysis to verify that the After Repair Value (ARV) indicated for the project corresponds with the latest comparable home sales in close proximity to the subject property.

In the beginning of April, HRIF was presented with a $133,000 mortgage located at 3145 South Hull Street, Montgomery, AL 36105. The developer was a repeat borrower with Fund That Flip and had successfully completed and exited 32 prior loans. The plan for this project was light rehabilitation, with a total construction budget of $40,453, a Loan to After Repair Value (LTARV) of 55%, and a Loan to Cost (LTC) ratio of 84%. Some of the major repairs items for the project included:

- New roofing

- Interior and exterior paint

- Updated flooring

- Updated electrical, plumbing, and HVAC

Given all factors listed above, while also being bullish on Montgomery, Alabama as a growing market, HRIF purchased this loan from Fund That Flip on April 3, 2023.

As the project progressed, the developer was able to quickly and efficiently work through repairs and upgrades. Between April 28 and May 23, the Fund disbursed three draws after an independent third-party inspector verified commensurate construction progress. On June 2, the developer repaid the loan in full and successfully exited the project. The loan was outstanding for just over two months.

As HRIF continues to grow, the team will seek similar opportunities, where the Fund can partner with a high-quality operator and bring new wealth and improved housing stock to established communities!

Contact Information:

For any inquiries, additional information, or referrals, please contact our Investor Relations Department:

ir@fundthatflip.com

(646) 895-6090

Thank you for your continued trust and support in Horizon Residential Income Fund I, LLC. We look forward to a successful and rewarding journey together.

Sincerely,

Matthew Rodak

Chief Executive Officer