Managing the draw process in real estate projects has traditionally been cumbersome, requiring endless forms, spreadsheet tracking, and email chains to track progress. For real estate investors leveraging a hard money lender, this process can be even more challenging.

Upright has revolutionized this process by integrating intuitive technology that simplifies draw requests and improves visibility for fix and flip investors and new construction developers alike. Here’s how:

Draw Pain Points Addressed:

-

Lengthy Forms and Manual Data Entry

-

Pain Point: Traditional draw processes require extensive paperwork, often requiring repetitive entry of previously provided information.

-

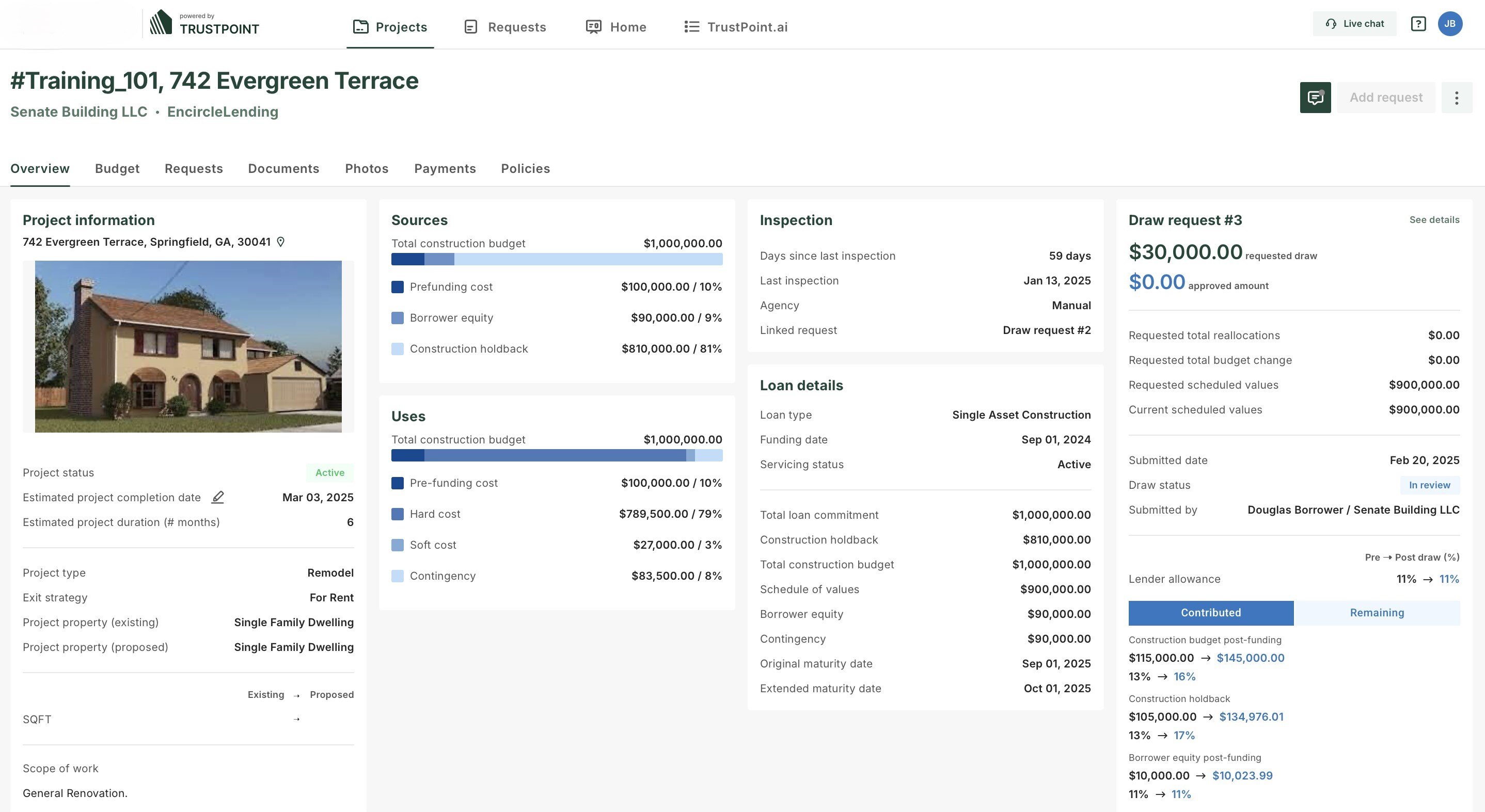

Upright's Solution: With Upright, your project details are securely stored in the system. When you submit a new draw request, only new or updated information is needed. The streamlined online interface simplifies data entry, significantly reducing time and errors.

-

-

Tedious Spreadsheet Management

-

Pain Point: Real Estate Investors often have to download spreadsheets, manually calculate balances, and re-upload updated versions for each draw request.

-

Upright's Solution: Your budget is preloaded into the system, with remaining draw balances automatically calculated. Simply enter the amounts you wish to draw against each line item on your prepopulated Statement of Work (SOW), eliminating spreadsheet headaches.

-

-

Disorganized Document Management

-

Pain Point: Keeping track of invoices, lien waivers, and other supporting documentation via email and cloud storage can be chaotic.

-

Upright's Solution: The platform allows you to upload all supporting documents directly into the system with your draw request. Everything is stored in one place for easy reference and streamlined approvals.

-

-

Unclear Status Tracking

-

Pain Point: Uncertainty about where your draw request stands in the approval process often leads to frustrating delays and follow-ups.

-

Upright's Solution: Upright provides real-time status updates on your draw request. You can see inspection requirements, pending approvals, and funding status, keeping you informed every step of the way.

-

-

Limited Access to Inspection Reports

-

Pain Point: Obtaining inspection reports and understanding funding approvals can be difficult in traditional systems.

-

Upright's Solution: Upright centralizes inspection reports directly in the platform. You can easily review inspection details and approved funding amounts alongside your draw request status.

-

By addressing these common pain points, Upright’s innovative platform provides a faster, clearer, and more organized solution for managing construction draws. Whether you’re a real estate investor managing a fix and flip project or a developer working on new construction, Upright’s draw management solution helps you efficiently manage your hard money loan process. The combination of intuitive design, automated calculations, and improved visibility makes the draw process simpler and stress-free for busy investors and developers.

If you’re tired of the outdated, inefficient draw process with other hard money lenders, let's talk about how we can help fund your next fix and flip or new construction project. Click below to apply for funding today!