In the previous articles of A Guide to Investing with Fund That Flip, we explained how to utilize Fund That Flip's platform to make wise investment decisions, keep track of your investments, and how to receive your payments. In this installment, we'll explain what happens to your money once it is invested with Fund That Flip.

Your Fund That Flip Account is an FDIC insured account, which allows you to keep funds on the platform. This account is the default payment method for interest and principal payments. This account is automatically created for the investor once they make an initial investment. The Fund That Flip Account can be used to fund investments. Those investments funded settle within a day, allowing the investor to start accruing interest faster.

Investors can deposit funds into their Fund That Flip Account and withdraw funds as long as they have a verified bank account added to their dashboard. Investors can monitor their account balance via the Fund That Flip Account at the bottom of the Accounts & Balances tab on their Investor Dashboard. This contains a transaction history of all payments that went into this account including: interest, extension fees, and principal payments. Investors can also download monthly statements from their Fund That Flip Account.

During the setup process for an investor’s legal entity, you will also be prompted to link an external bank account (setup instructions can be found in section 9.B). After your first investment is submitted, you will be able to select your linked external bank account as the target account for all payments. If this option is selected, all payments for the investment will be sent directly to that external bank account. Payments will typically settle into that account within 3-5 business days.

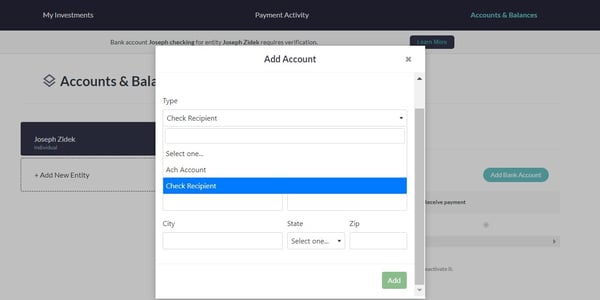

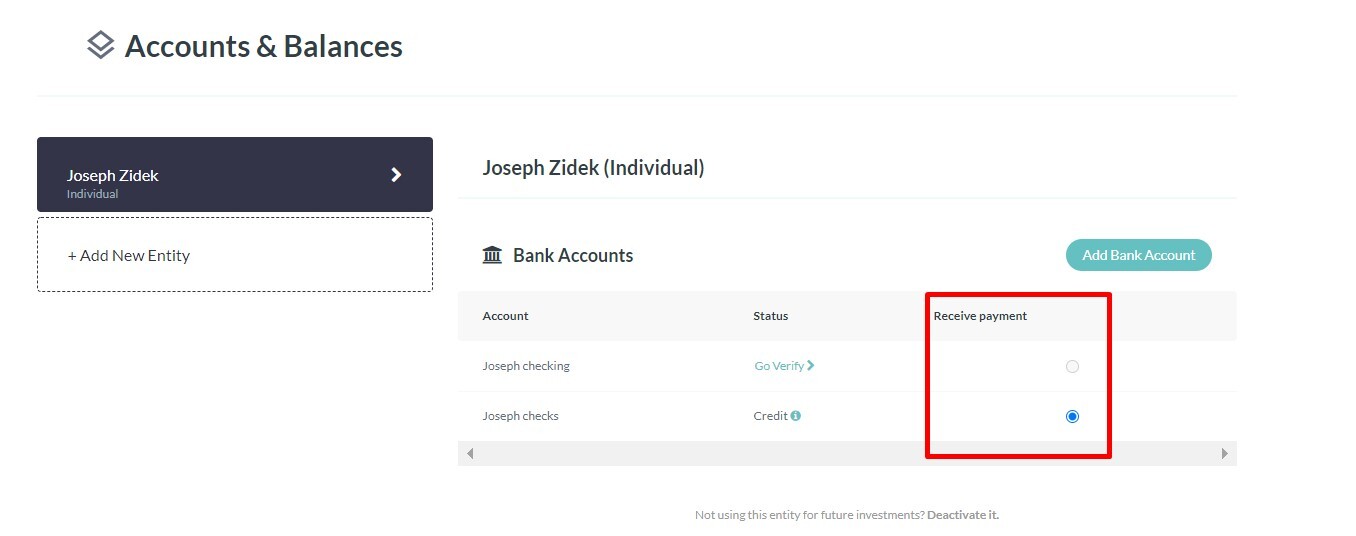

Investors also have the option to receive payments by check. To do this, you would click on "Add Account," select "Check Recipient," and enter the appropriate information. Checks are sent by the US Postal service and time until received is dependent on them. Investors can change which account receives payments for their entity by navigating to their "Accounts and Balances" tab of the dashboard. There, you will see all the accounts connected with that entity. Simply checking the account that you want to receive payments will change your payment method.

After selecting either an external bank account or Fund That Flip Account balance as the target account for investor payments, investors will also receive email statements whenever a payment settles into the account of their choosing. This statement is intended to give investors more visibility and insight into the money that they are receiving for each of their investments. The statement will outline the amount of the payment that you received into your account that day, and it will also highlight the deal the payment is associated with, along with the payment type (Principal, Interest, Fees).

If you have any questions regarding how a project you invested in is progressing, we encouraging you to reach out to us by email at investorrelations@fundthatflip.com. Once your email is received, one of our Investor Relations representatives will be able to help get your questions answered.

Read previous or next article:

Ready to make another investment? Browse our open deals and earn as high as 10% annual returns!