As the coronavirus (COVID-19) continues to spread globally, we thought it to be important to share our thoughts. The anxiety, serious illness, and the loss of life are heartbreaking, and our thoughts are with all those who have been impacted. Like many other organizations, we have implemented a plan to ensure our teammates and customers are being proactive to protect themselves and limit the spread of the virus.

As anxiety about the virus has spread to the financial markets and threatens global economic output, many are beginning to wonder what effect the virus might have on, among other industries, the residential real estate market. There are many variables and unknowns that could ultimately influence the impact the virus has on the residential real estate market. And while it is impossible to predict how any series of events will ultimately play out, this post highlights what we believe are some of the key factors to keep an eye on.

Slowing Buyer/Seller Activity

There is some concern that buyers will delay purchasing decisions, as they don’t want to expose themselves to the virus by touring homes. Similarly, there is some concern that sellers won’t want potential buyers touring their homes, potentially bringing the unwelcomed virus with them. While this may be the case for some, and this risk grows if the virus continues to spread, we feel this is a relatively low risk. We believe any slowdown will be temporary and is unlikely to alter plans of buyers and sellers.

Purchasing or selling a home is typically driven by larger forces, such as new couples getting married, young couples growing their family, or empty-nesters downsizing. Any delay the virus may cause is likely to be short-lived, and buyers and sellers will return to the market as the spread is eventually contained and anxiety is quelled. A considerable compensating factor to this, which is discussed in greater length below, is the historically low mortgage rates that currently are available to buyers.

Key Takeaway: While there may be some slowdown in activity in the immediate near term, this is likely to be short-lived and is unlikely to have a long-term effect on supply and demand.

Mortgage Rates

The combination of the recent flight from equities into T-Bills and Federal Reserve monetary policy has caused historically low interest rates. This has a dual positive effect on the housing market. The first is that it has created urgency for many buyers to lock in these low rates by purchasing a home sooner rather than later. Lower interest rates also increase buyers’ purchasing power. A lower rate means a lower monthly payment, often resulting in the ability to purchase “more house.” One of the biggest challenges for buyers right now is “attainability,” meaning many buyers have the financial wherewithal to purchase a home, but there is little supply within their price point (more on this below). Lower mortgage rates help increase the number of homes that are attainable to these qualified buyers.

Another potential positive is that the Fed tends to move swiftly when reducing rates, as exhibited in last week’s 50bps emergency rate cut. On the flip side, when it comes to raising rates, this tends to happen more gradually and over longer periods of time. Even if this pullback is temporary, and we hope that it is, lower mortgage rates are likely to remain for some time. It’s also likely this will provide a long-term benefit to the overall housing market.

Key Takeaway: Low mortgage rates will incentivize buyers to stay in the market. These low rates are likely to continue into the future, helping maintain strong demand for housing.

Impetus for Recession

Governments and health officials throughout the world are working around the clock to help contain the spread of the virus. We have faith that these efforts will eventually lead to the virus being contained and that normal business will resume. Whether this happens in two weeks or takes many more months is, of course, impossible to predict. In either case, there is strong evidence that the slow down in production, reduction in consumer discretionary spending, disruptions to supply chains, and slow down in business investment will create slower GDP growth than originally expected. In a worst-case scenario, this may trigger a more prolonged reduction in business activity or even cause a recession.

So, the question then becomes, “What happens to residential real estate in a recession?” Most of us remember the previous recession and how significant the effect was on real estate (being in the industry, we also think about this a lot). However, we think it wise to take a look beyond just the most recent recession. Going back 50 years to study how residential real estate has performed in the past five recessions, you’ll note that housing actually increased in value in three of the five recessions and only decreased in value by 0.9% in the fourth.

The data therefore suggests there is not a strong correlation to real estate performance and recessions. Take a look at the infographic from ATTOM Solutions via Curbed below:

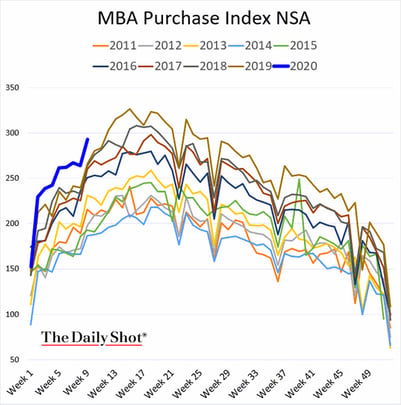

To help us understand what may happen this time around to housing prices if we do end up in a recession, let’s again look at the data. Housing, like any other market, is a function of supply and demand. First consider the demand side of the equation. A strong leading indicator for demand is the number of mortgage applications for purchases. This represents the number of people who are seriously and actively in the market to purchase a new home. As revealed by the chart below, demand is at historical highs. There are a number of factors driving this level of demand, including record low unemployment, wage growth, demographic changes (e.g. millennials growing up, starting families and being the largest part of the United States workforce) and population growth, just to name a few. Even a 10-15% reduction in the index would still indicate considerably strong demand.

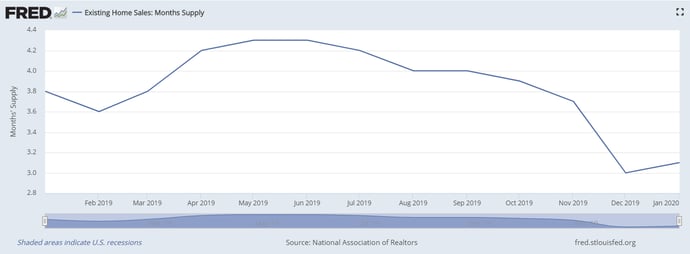

On the supply side, the data suggests that, if anything, there is a shortage of “for sale” housing. As of January, there was just over 3 months of supply of existing home sales. For a bit of context, less than 6 months of supply generally means a favorable “sellers’ market,” while more than 6 months of supply favors buyers. An ideal balance has between 5 and 6 months of supply. A high of 7.5 months’ supply was the peak leading up to the 2008 crash as speculation outpaced demand. Currently, we are at nearly half of the supply needed for a balanced market.

Key Takeaway: While it’s very possible that the coronavirus becomes an impetus for a recession, historical data tell us that recessions and real estate are not nearly as correlated as we often think. Further, the current supply and demand data suggest that the residential real estate market is well positioned.

Fund That Flip’s Plan of Action

We will continue to keep a close eye on the fundamentals of the market as events unfold over the coming weeks and months. We’ve established a task force to regularly review new data as information becomes available and will be updating our strategy accordingly.

One of the founding objectives of the company was to create an asset class that offered attractive returns which are uncorrelated to the ebbs and flows of public markets. In uncertain times such as these, we believe in that mission to provide an alternative to the volatile public markets and that investing in residential real estate debt offers fair risk-adjusted returns and complements a well-balanced portfolio.

As always, please contact us at investorrelations@fundthatflip.com with any questions and comments.

- Matt Rodak, CEO

---

Fund That Flip, Inc. does not make investment recommendations, and any information found herein should not be construed as such. Information found on this website is not an offer to sell or the solicitation of an offer to buy any security, which can only be made through official offering documents that contain important information about risks, fees and expenses. Any investment information contained herein has been secured from sources Fund That Flip, Inc. believes are reliable, but we make no representations or warranties as to the accuracy of such information and accept no liability therefor. We recommend that you consult with a financial advisor, attorney, accountant, and any other professional that can help you to understand and assess the risks associated with any investment opportunity. Fund That Flip, Inc. is able to make investment opportunities available, only to accredited investors who submit required verification.