Whenever I speak with developers who use the Upright platform, I am always curious to ask how they got into property development, and why they do it. The same is true with our passive investors, those who invest through the Upright platform, placing their trust in developers they have never met, and in projects they will probably never see.

I could write a book with the range of responses I get to the first question, “How did you get into property development?” But when it comes to the second, of why they do it, there is a common theme: The desire for freedom and independence.

The Independence Incentive

For many that primarily means financial independence. Most of us aspire to not having to worry, financially speaking. There is no denying that while money cannot buy health or happiness, it does provide the ability to make choices about how one lives and works. That means different things to different people, of course. It may mean simply being one’s own boss. Or it may mean the ability to travel more, or buy a vacation home, or retire early, or all of those things. And for many, it means the ability to leave something to one’s children and grandchildren. Property is the number one means of creating generational wealth, which is why investing in real estate is seen as such a strong path to financial freedom.

But freedom and independence is not just about finances. There is a different type of wealth that many of our investors are also seeking: The richness that comes from greater autonomy, from not being tied to a 9–5 job or someone else’s schedule. In real terms, that means the ability to spend more time with one’s family and loved ones.

Whatever the desired goals, the investors I speak to have all recognized that real estate investment is a means of achieving them. And for many, investing in a long-term rental property or properties is a simple and effective route — especially with a question mark hanging over the viability of short-term, Airbnb-style rentals in many parts of the country.

Here, I’m going to break down the wealth-building potential of a long-term rental strategy:

Cash Flow: A Steady Stream of Income

Cash flow is one of the most appealing aspects of residential real estate investment. Unlike some other forms of investment, such as stocks, real estate can provide a steady stream of income in the form of rental payments, if you buy a property and become a landlord.

Rental income from real estate investment can cover not only the property’s operational expenses, but also generate a surplus, which adds to your monthly income. This extra revenue stream can be a lifeline, especially during economic downturns or when you’re planning for retirement.

Appreciation: The Value of Long-Term Growth

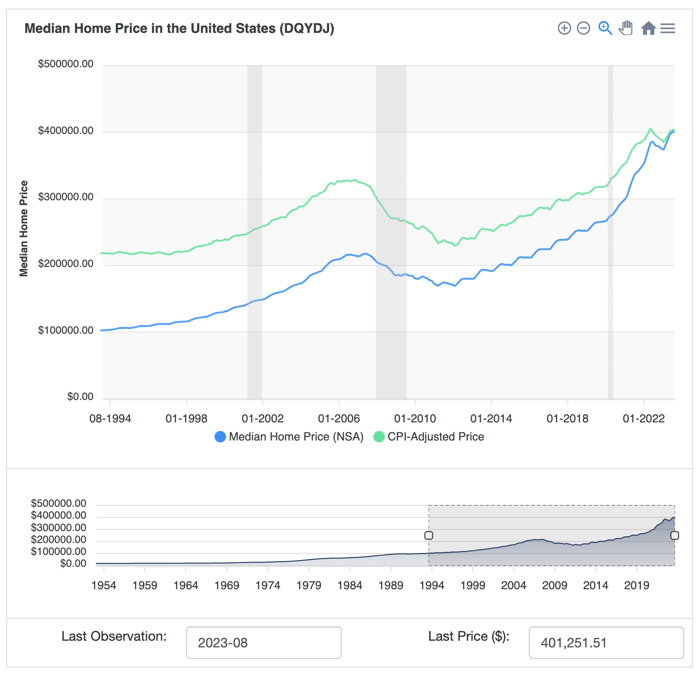

Real estate properties have historically appreciated over time. While there can be short-term fluctuations, and the rate of appreciation can vary depending on location and market conditions, real estate values have generally shown an upward trend in the long run. This appreciation can significantly contribute to your wealth-building journey.

When your property appreciates, its market value increases. This not only gives you the potential to sell it for a profit later, but also allows you to leverage the increased equity in the property for various financial purposes, such as taking out loans or reinvesting in other properties.

Image from https://dqydj.com/historical-home-prices/

Image from https://dqydj.com/historical-home-prices/

Tax Advantages: Keeping More of Your Earnings

Real estate investment offers several tax benefits that can help you keep more of your earnings. Some of the key tax advantages include:

- Depreciation: The IRS allows you to depreciate the value of your investment property over time. This non-cash deduction can significantly reduce your taxable income.

- Capital gains tax benefits: When you sell a property, you can potentially benefit from capital gains tax advantages, such as a reduced tax rate for long-term holdings.

- 1031 Exchange: This provision allows you to defer paying capital gains taxes when you reinvest the proceeds from a property sale into another like-kind property.

These tax benefits may put more money in your pocket, helping you grow your wealth faster.

Leverage: Amplifying Your Investment Power

Leverage is a powerful tool in real estate investment. It involves using borrowed money to acquire properties and multiply your investment potential. When you invest in real estate, you have the opportunity to use a combination of your own funds and borrowed capital.

For instance, if you purchase a property with a mortgage, you only need to provide a down payment, often a fraction of the property’s total value. The rest of the funds are borrowed. If the property appreciates, your returns are calculated based on the total property value, not just your initial investment. This leverage can magnify your returns, making it a potent wealth-building strategy.

Moreover, if the rental income covers your mortgage and operational expenses, you essentially have other people (your tenants) paying off your mortgage, further boosting your equity and wealth.

The Path to Financial Freedom with Real Estate Investment

Real estate investment is not a get-rich-quick scheme. Building wealth through real estate is a long-term endeavor that requires careful planning, patience, and a degree of risk management. Here's how to get started on your journey to wealth through real estate

- Research: Before you make any investments, thoroughly research the real estate market in your chosen area. Consider factors like location, property type, and market trends. Understanding your target market is crucial for making informed decisions.

- Financial planning: Assess your financial situation and create a budget. Determine how much you can comfortably invest without straining your finances. Consider working with a financial advisor to ensure your investment aligns with your overall financial goals.

- Property selection: Choose your investment properties wisely. Look for properties with potential for cash flow and appreciation. Evaluate the neighborhood, property condition, and potential rental income.

- Financing: Explore your financing options, such as mortgages or real estate investment loans. Calculate your potential cash flow to ensure it covers your expenses and provides a profit.

- Property management: Decide whether you will manage your properties yourself or hire a property management company (although this will eat into your margins). Managing your own properties can save money but requires time and effort, while a management company can handle the day-to-day tasks for you. There are pros and cons to both options.

- Long-term perspective: Approach real estate investment with a long-term perspective. While you may have short-term financial goals, real estate’s true wealth-building potential shines over several years or even decades.

Bricks and Mortar vs. Stocks and Shares

For those without the skills, appetite, or risk tolerance to pursue a ‘fix and flip’ approach, building a rental portfolio is an attractive route to that desired freedom and independence.

There’s something else, too, that I often hear from investors: And that is the attractiveness of investing in something tangible, something you can see and touch. That is true of real estate in a way that cannot be said for many other types of investment, and can be a source of great pride and satisfaction — as well as security.

DSCR (debt service coverage ratio) loans are now available from Upright, for those investing in long-term rental properties. https://www.upright.us/loans/dscr-rental