The top factors holding back private real estate developers — and a way forward.

Two weeks ago we published our report on the economic and social impacts of private real estate developers on the communities in which they work — 'Here Comes the Neighborhood'. The report clearly shows (spoiler alert!) how neighborhoods that see the type of development practiced by our active investors experience a host of benefits, from improving property values, to greater local economic activity, even improved levels of health and happiness. All of this in addition to the core business of building new homes. You can read the full report for free, here.

The data we examined in our research tells us a lot, and we analyzed dozens of sources, but we also wanted to take the temperature of those at the sharp end, and find out what our customers think about various issues.

Taking the temperature

Speaking with active investors is always a valuable experience. It is a vital part of determining our product roadmap, informing how we can improve our current technology, and how we prioritize new products and features. So when we came to produce ‘Here Comes the Neighborhood’ it was important to us that we included the voice of the developer, and I want to share some of what we found.

I should emphasize this is not the most comprehensive survey, and represents a relatively modest sample of active investors, so one should be wary of drawing too many sweeping inferences. Nevertheless, I believe it tells us a lot about the attitudes and opinions of private developers, and therefore how we at Upright can help. Here are my main takeaways:

1. Private real estate developers would build more if they could: Confidence tends to be a hallmark of private real estate developers; they are generally bullish anyway, but what was striking about the results of our research was how emphatic those we surveyed were.

When we asked, “If you could take on more projects, would you?” every single one of our respondents said “Yes."

This speaks to the ambition we see in so many of our developers and redevelopers, but also to their strong belief in the role they and their peers have to play in closing the gap between housing demand and supply in the U.S. — something reinforced when we asked about that specifically.

2. They recognize the importance of their work: Developers are not just in it for the money. Don’t get me wrong, this is a commercial endeavor, and everyone wants to make a healthy return. But I think it is also fair to say that private real estate developers recognize they are doing something whose value goes beyond dollars and cents: They are building homes for people. And they are doing so in an environment in which demand outstrips supply, and is not being met by the major house builders.

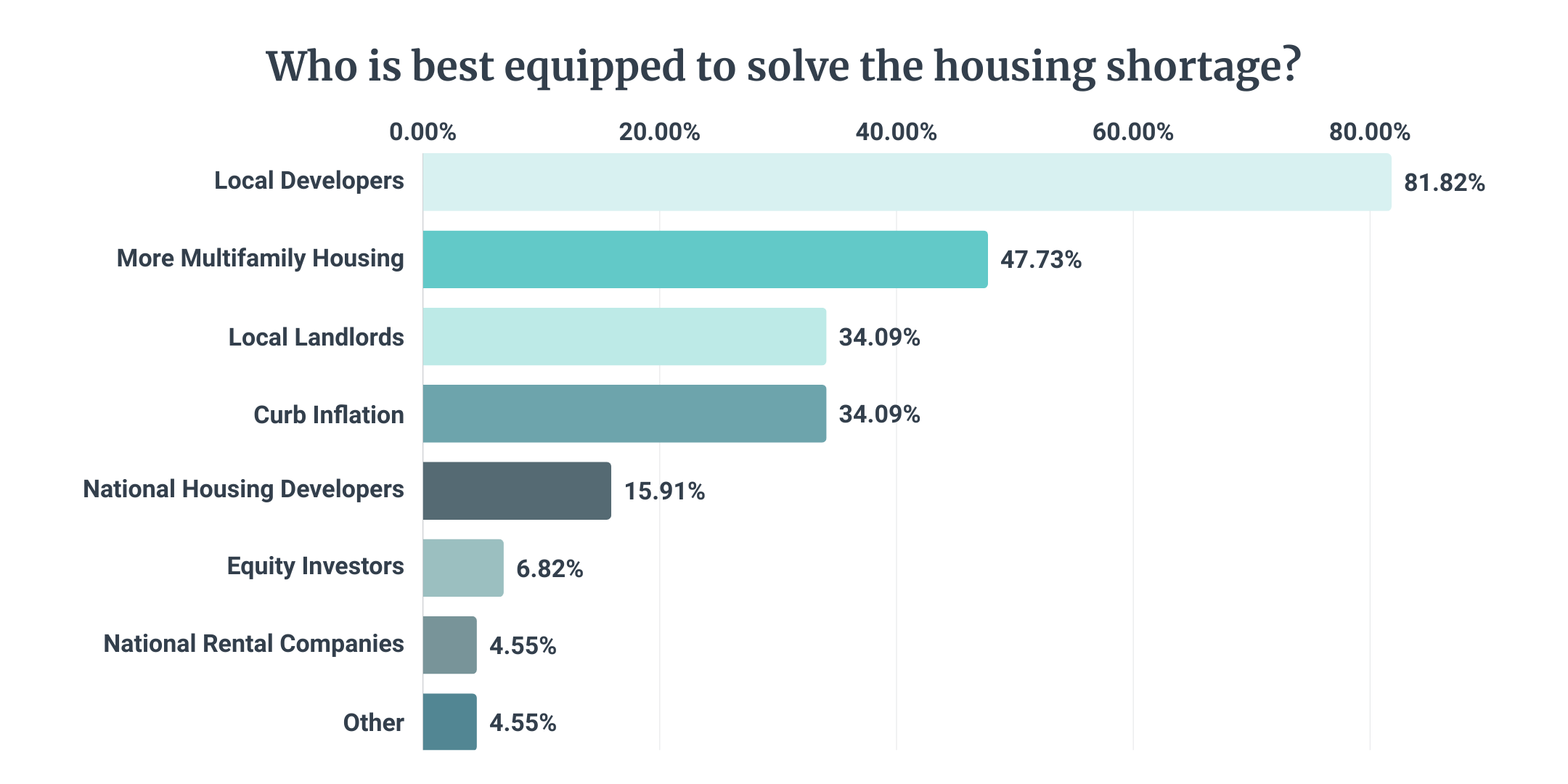

We asked: “Who or what do you think is best equipped to solve the U.S. housing shortage?” Many referenced the need for more multi-family housing, the challenges presented by inflation and high-interest rates, and the role of local landlords in making more desirable rentals available. But eight out of 10 cited the role of people like them — local developers and redevelopers.

I do not believe this is arrogance or myopia, but a recognition born from experience that not everyone wants to live in the types of larger development undertaken by the big house builders. That’s the role that private developers play, and our customers made it clear they understand that responsibility and are proud to rise to the challenge.

3. A range of issues hold them back: So, private developers have a strong belief in the importance of what they are doing, and would take on more projects if they could. So what is holding them back?

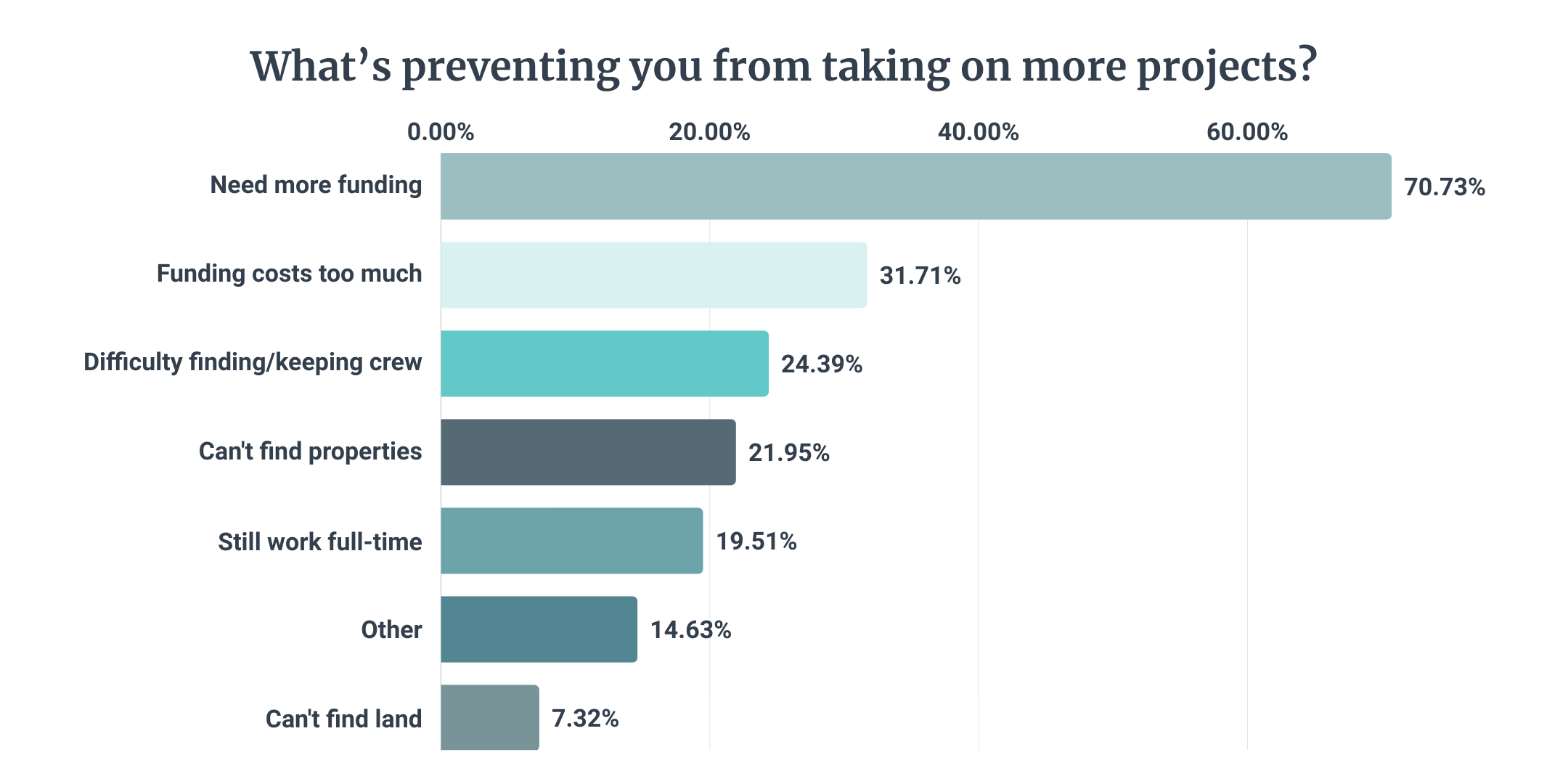

We asked: “What is preventing you from taking on more projects?” and received a range of responses. Finding the right properties or land is an issue for some, while finding and maintaining crew remains a challenge for many, reflecting the available data about the labor market. Then there are the practical challenges of being an entrepreneur, like insufficient bandwidth (“Busy with other projects” was a common response), or for some, still having to work a full-time job.

The most common challenges, unsurprisingly, were around funding: Obtaining it, and the cost of it. The need for more funding was the number one barrier to our investors building more.

Meeting the need

In many ways, this research reinforced what we already knew or suspected: That our developers are bullish, ambitious, and clear-eyed about the importance of what they do; but also that there is friction at every stage of the process.

This is particularly acute with funding, since without that every other issue quickly becomes irrelevant — which is why funding is the core of what we do at Upright.

But just as our customers have ambitions to do more, to build more, our ambition is to go beyond funding and help with every aspect of their projects. That’s why Fund That Flip and FlipperForce, the real estate developer software, came together under the new name of Upright: We are removing the friction experienced at every stage of the developer’s journey, and this new research has made us more determined to do so.