Did you miss the 2023 BiggerPockets Conference? No worries. Upright attends every year with an exhibitor booth, as well as an opportunity for our employees to learn, network, and stay up-to-date on the latest in real estate investing.

Here are some of the key takeaways on this year’s hottest topics and discussions:

Creative Financing

In a workshop led by Pace Morby and Jerry Norton, attendees learned a variety of acquisition and exit strategies, with a focus on how to creatively finance them outside of typical lending scenarios.

A few popular creative financing strategies:

The Seller Finance Method:

In this creative financing strategy, the seller takes a cash offer from the redeveloper/buyer — but instead of receiving the money all at once, the seller agrees to regular payments from the buyer. It’s similar to a regular bank mortgage loan, but cuts out a bank and puts the seller in charge of the money.

The Morby Method:

The Seller Finance Method, but the buyer is also getting financing via a DSCR loan (which is dependent on cash-flow ability of the subject property), as well as private money to fund the cash offer.

The SubTo or Sub 2 Method:

This creative financing strategy has the redeveloper/buyer taking over the seller’s existing mortgage to avoid involving banks. This means that the new loan is subject to (SubTo is short for “subject to”) the terms of the seller’s existing mortgage.

These are all well and fine as each real estate investor has different goals, processes, etc. We’re a hard money lender, so we are the fast, reliable, and simple option for financing. You trade some savings for speed, reliability, and simplicity when you work with us.

If you’re going to attempt to implement any of the above creative financing methods to acquire your next investment property, our advice:

- Make sure you fully understand the entire process, from analysis of the property to your exit strategy, as it relates to your creative financing.

- If you are utilizing another investment strategy, for example, BRRRR. Make sure you understand how BRRRR fits into your creative financing strategy. If your property doesn’t appraise at what you expected, creative financing may not be able to help you make up for the lost profit.

- In our opinion, these strategies are better for experienced developers who fully understand the ins and outs of real estate investing and financing — and have the time to dedicate to a more involved funding solution.

Interest Rates in 2024?

It wouldn’t be a real estate conference without at least one discussion about rates.

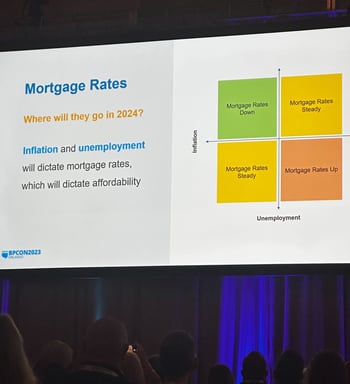

In the keynote speech from Dave Meyer, BiggerPockets’ VP of Data and Analytics, he discussed that regardless of what interest rates look like in 2024, you need to have a plan for your business. (Image is from Dave Meyer's keynote speech.)

In the keynote speech from Dave Meyer, BiggerPockets’ VP of Data and Analytics, he discussed that regardless of what interest rates look like in 2024, you need to have a plan for your business. (Image is from Dave Meyer's keynote speech.)

We wholeheartedly agree with this. Since mid-2022, the housing market has been confusing and contradictory, with no clear trend line. Instead of hoping the economists will be able to deliver us a solid prediction or map for 2024, we all need to plan for three scenarios and create a business plan for each one.

- Interest rates go up.

- Interest rates go down.

- Interest rates stay the same.

In our opinion, successful investing comes from being aware of the macroeconomic trends and planning for how you’ll respond, regardless of what actually happens. We operate the Upright business the same way, with multiple streams of revenue, products, etc. to help us weather any economic or cultural changes.

Rates, Inflation, and Unemployment

One of the sessions stated that in order for rates to go down, inflation would also have to go down and unemployment would have to increase significantly to show signs of a cooling labor market. The discussion revolved around what dominoes would have to fall for this scenario to happen.

While we’re not economists, we feel the more pertinent question is: If this scenario did happen, does it mean that the housing market and real estate investment would improve? Maybe not. Unemployment rates are intrinsically tied to the housing market and the economy as a whole.

According to the Journal of Monetary Economics, “...a higher unemployment rate increases the difficulty of selling a house and thus weakens homeowners' tendency to move. Therefore, when the unemployment rate increases (decreases), there are fewer (more) buyers and sellers.”1

Additionally, The Federal Reserve Bank of St. Louis (FRED) found that when researchers examined the correlation between housing prices and unemployment during the Great Recession, “... the results showed a strong negative correlation, meaning that counties with larger decreases in housing prices experienced larger increases in the unemployment rate.”2

The low unemployment rate has been a key signifier to economists claiming we are not in a recession currently. In September 2023, the U.S. unemployment rate was holding steady at 3.8%, nearly a 50-year low.3 So while we understand that everyone wants rates to be lower (except maybe passive investors who are experiencing a great ROI), we also understand that lower rates could come at the expense of unemployment, which we believe could harm the housing market and possibly push the U.S. into a recession.

Don't want to miss events like this? Check out our Events Calendar to see what conferences, networking events, and happy hours we'll be at near you.

Brendan Bennett is a real estate investor, as well as Upright's VP, of Revenue, and the co-host of our podcast, Real Estate Investing Unscripted.

Sources:

1 Journal of Monetary Economics

2 Federal Reserve Bank of St. Louis

3 US Bank