Fund That Flip is dedicated to industry-leading transparency into our business processes and performance, so we provide our stakeholders and lenders with relevant updates on loan origination and performance, technology updates, and new offerings.

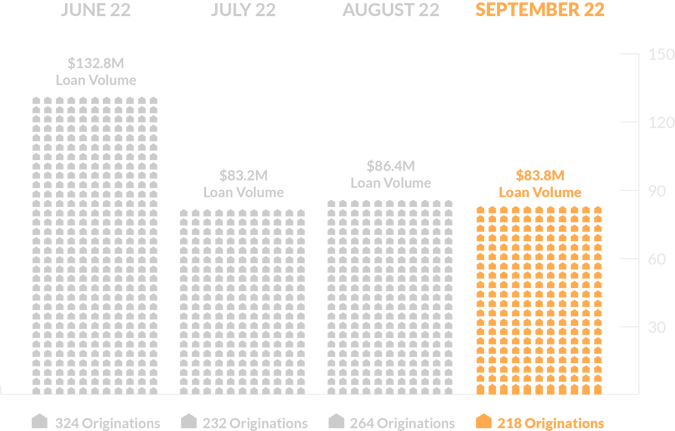

In September, we originated 218 loans, totaling more than $83.8 million in origination volume.

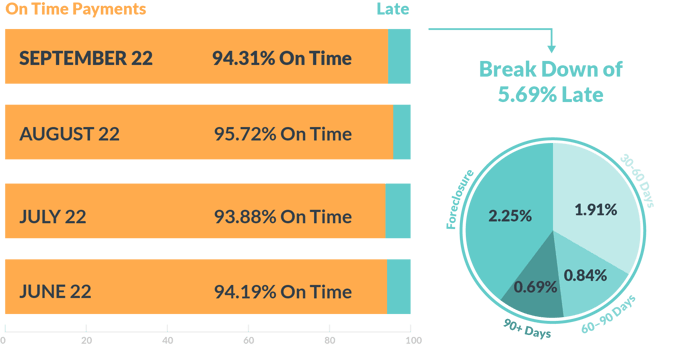

Additionally, as of October 1, 5.69% of our book was 30 days or more late on payments.

We’re seeing these numbers for a few reasons:

- Continued economic and market uncertainty. For more on what's affecting the market, I recommend reading our blog post on the housing market's return to "normal."

- Several high-dollar loans remain delinquent (with priority on exit and repayment).

- Continued supply chain issues and labor shortages contribute to construction delays and eventually, delinquencies.

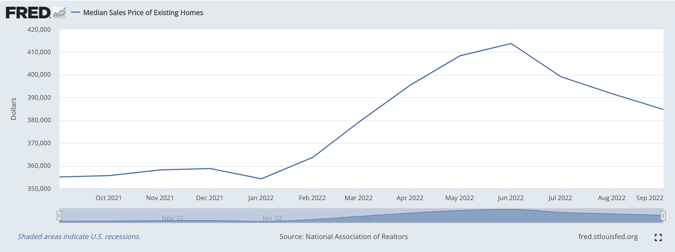

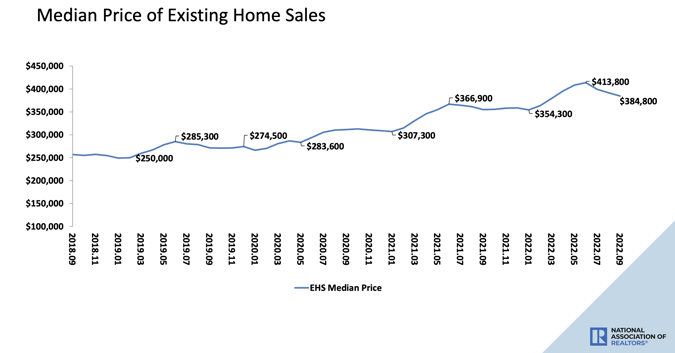

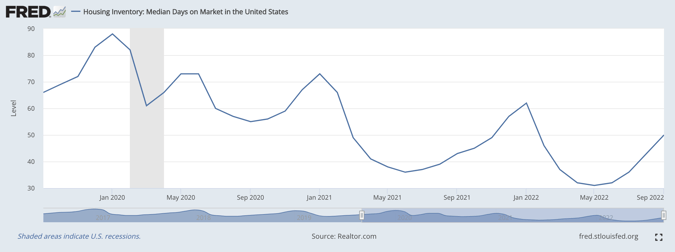

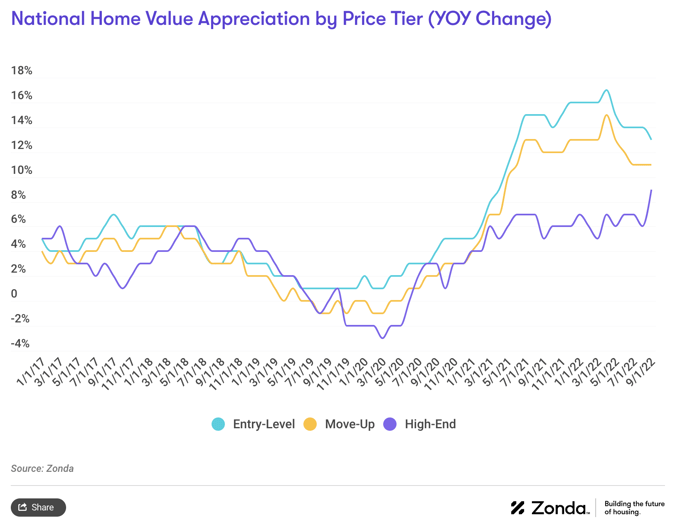

As of September 2022 across the U.S., we're seeing these trends across the housing market, including increased home prices nationally, year-over-year. Appreciation is beginning to slow down (although we're still far from even pre-pandemic levels).

- Median Home Sale Price (existing homes): $384,800, +8.4% year-over-year*

- Sale-to-List Price: 99.2%, –1.8 points year-over-year^

- Homes for Sale: 1.7M, +2.6% year-over-year^

- Median Days on the Market: 50, +7 days year-over-year**

- Months of Supply: 2 months^

As always, we're actively working with our borrowers to keep their projects moving forward, on track, and current on payments.

- Our Servicing and Sales teams are in regular contact with each other and borrowers to ensure payments and projects are current before proceeding with new loans for the same client.

- Servicing and Asset Management teams continue to review delinquent accounts to determine if a notice of default letter needs to be issued — the sooner the better.

- Additionally, the Servicing team provides timely updates on loan performance, but also diligently works to ensure as few loans as possible are delinquent longer than 30 days.

Learn more about how we handle loans that are 30+ days late in an episode of Investor Insights here.

We believe it's best to support our borrowers to exit their loans as successfully as possible — even if delinquent or in the foreclosure process — in order to preserve principal and speed to liquidity.

We're also continuing to build a strong forward pipeline even in a somewhat uncertain real estate market, remaining selective on markets to enter and what projects we fund by putting an even stronger focus on appraisals and historic performance. The Fund That Flip operational and business strategy is designed around utilizing a diverse capital stack so we're always positioned to weather market volatility and come out ahead.

If you have any questions or would like to provide feedback, email us at investorrelations@fundthatflip.com. We will respond as soon as possible.

Log in to your account here, or start investing.

*https://fred.stlouisfed.org/series/HOSMEDUSM052N

^https://www.redfin.com/us-housing-market

**https://fred.stlouisfed.org/series/MEDDAYONMARUS