Investing in real estate online is still a new frontier. If you’re reading this you should feel good that you are on the leading edge of what we believe to be the start of a huge new asset class for main street investors.

Like anything else that is new, investors are diligently working to understand the risks associated with this new asset class. A prudent investor sees the attractive double-digit annualized returns and intuitively knows that the risks likely correlate with the return.

Many of us at Upright are active investors in online real estate debt, both on our platform and others. As they say, we’re eating our own dog food! Over the past 18 months we’ve developed a perspective, as investors, as to what really drives risk of each project and have developed our underwriting model with an “investor-first” mentality.

Before we put our own hard-earned capital at risk we need to have one really simple question answered… "Are incentives aligned?”

Quite simply, we want to see that the real estate developer (borrower) has aligned incentives with us, as the investor. We simplify this with one principal – does the borrower have a meaningful amount of their own capital in the project?

As simple as this sounds, there are a few things to watch for when analyzing this:

a.) When is the developer receiving distributions?

b.) What percentage of the actual cost of the project does the total distribution represent?

c.) How much is the property worth in its current condition?

Simple Case Study

To illustrate, this let's look at a few example scenarios. For these examples, our borrower is purchasing a house for $100,000 and intends to invest $30,000 in improvements. The expected After Repair Value (ARV) is $200,000. Most platforms will lend up to 80-85% of purchase price + up to 100% of the rehab costs as long as the total loan amount is less than 65-70% of the ARV. So in this case, our max loan amount will be $80,000 + $30,000 or $110,000. (Note that this is less than 70% of the ARV, $140,000).

For the sake of these examples we’ll agree that the value of the property has been verified via third-party appraisal, which for us is mandatory.

The Proper Distribution Sequence

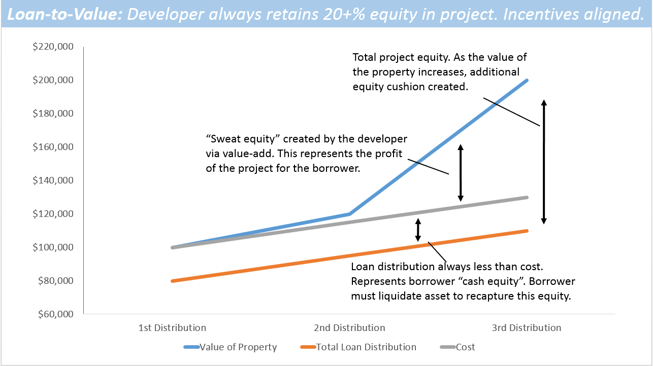

First, let’s look at what we’d consider to be the correct way to manage the distributions and “alignment of interests” for this project.

We’d want to see that the first distribution to the borrower doesn’t exceed 80% of the cost of the project at that given point in time. So first distribution should be no more than $80,000. This means the developer would have $20,000 + closing fees of their own capital into the project on day one. You’d have a 20% cushion provided by the developers equity to protect your investment, and more importantly, the developer has skin in the game and an incentive to see the project is completed and sold.

The proper sequence requires that the developer invest additional capital to improve the property before the platform releases any of the allocated $30,000 in rehab funds.

After the initial distribution of $80,000, the developer begins the rehab by installing a new roof, HVAC and water heater spending an additional $15,000 of their own capital. Now the developer has $35,000 of their own capital in the project and the value of the property has presumably gone up in value with these improvements.

At this point, subject to an inspection, it would be appropriate for the platform to release additional funds from the rehab escrow. To keep it simple, let’s say the platform releases $15,000 to the developer to cover the investment that they’ve made.

At this point, the distributed proceeds of the loan would be $80,000 + $15,000 = $95,000. Total expenses on the project are $100,000 + $15,000 = $115,000. The loan-to-cost ratio based on what’s been distributed is $95,000/$115,000 or 82%. The developer still has $20,000 of their own capital locked into the project keeping incentives aligned.

The developer continues the improvement process by installing new kitchen, bathroom, restores the floors and paints the entire house spending the remaining $15,000 of their budget. Subject to another inspection to verify work has been complete and the house is ready to be sold, the platform would be right to release the remaining $15,000 for total loan distribution of $110,000 on total cost of $130,000 or a 85% loan-to-cost ratio.

The key here is that the developer still has at least $20,000 of their own equity in the project.

Further, if the estimated ARV has been done properly, the loan-to-value of the rehabilitated house is now $110,000/$200,000 or 55% giving you 45% equity protection against your loan.

Albeit a relatively simple example, this is how we like to see distributions being made.

Key Takeaways:

-

The developer always has at least $20,000 of their own capital locked into the project ensuring that if they want to see that money again they need to complete the project and get it sold.

-

Advances from the rehab budget were made after the works is done. This ensures value is being added before capital is released to ensure that loan-to-cost hasn’t exceeded 100%. As rule we like this to stay under 85%.

-

Inspections are being made on the property prior to releasing funds to ensure that the work has actually been completed.

So now that we know how it should happen, let’s look at some common mistakes that could cause you to be over-exposed to unnecessary risk.

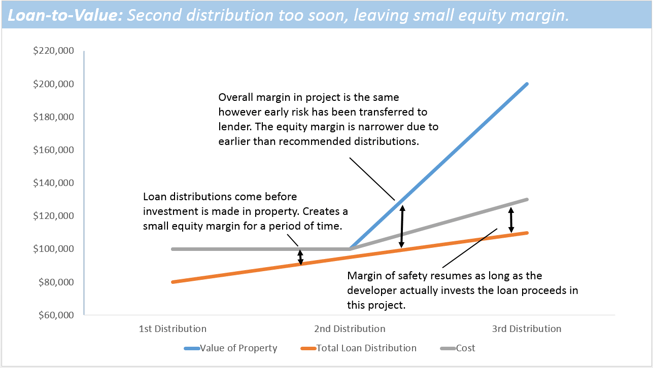

Mistake #1: Pre-Mature Construction Distributions

The most common mistake we see is advancing loan proceeds to developers before work is complete.

Using the same example, let’s say that the platform makes the first distribution of $80,000. They then immediately advance the borrower the second $15,000 so he can buy roofing materials, HVAC and hot water equipment.

At this point the total cost of the project is only $100,000 (materials haven’t been purchased or installed and work hasn’t been completed) but the borrower has received $95,000 in proceeds. This means they only have $5,000 of their own capital in the project. This scares us.

What if the borrower uses those proceeds for another project, doesn’t buy the roofing materials or HVAC equipment? Now your project could be at risk and the borrower can walk away with only $5,000 on the line.

Key Takeaway – Pay very close attention to WHEN the platform is making distributions. If the first construction distribution is coming right after the initial purchase distribution then you’re right to be concerned.

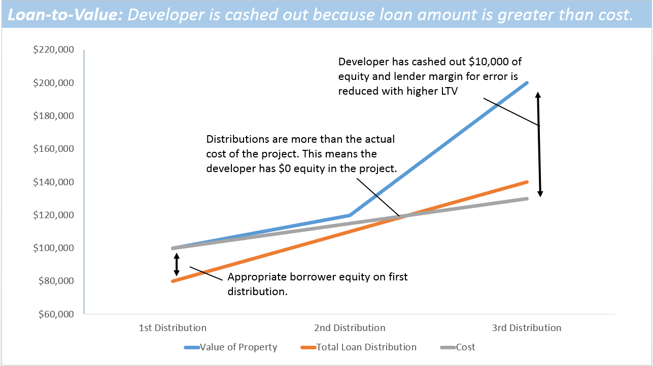

Mistake #2: Total Loan Amount Based on ARV Instead of Percentage of Cost

The second biggest mistake we see is that platforms set the max loan amount on a percentage of the ARV and don’t cap it based on a percentage of the total cost of the project. Using the same example as above, the max loan amount based on 70% ARV could be as high as $140,000 (70% x $200,000). However the total cost of the project is only $130,000.

Why is this a problem? Let’s say that the platform manages distributions the appropriate way as outlined above. $80,000 is released on first distribution and the remaining $60,000 is released after work has been done. Remember there is only $30,000 of work needed. So on the last distribution, the total cost of the project is $130,000 and the total distribution is $140,000. In this case, the developer has cashed out $10,000. They could walk away up $10,000 without doing anything else!

This becomes problematic because in order for you to get your principal back the borrower has to sell the house. If they have $0 left in the project (or in this case already made $10,000) and something goes wrong, it’s too easy for them to walk.

While you still have good equity protection in the house ($140,000 invested on a $200,000 property) you are counting on the borrower to liquidate the property. If they decide it’s no longer worth their time to do so, your principal will get tied up in a foreclosure or some other asset liquidation strategy which may not end up being ideal.

Key Takeaway – Make sure the total loan amount is always less than the total cost of the project. Don’t blindly invest on ARV percentages alone. If there is potential for the borrower to cash out all of their equity, or even cash out positive equity, you should be very concerned.

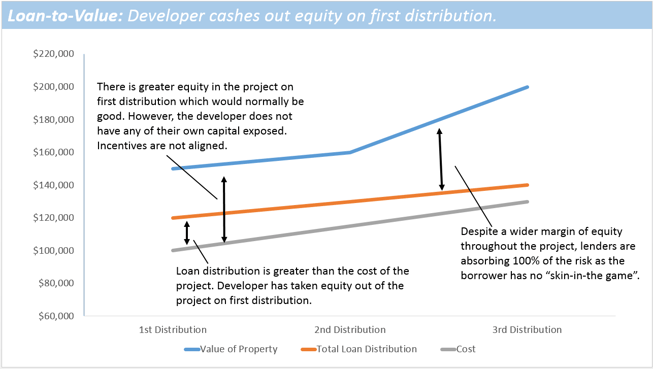

Mistake #3: Initial Distribution Based on Percentage of Appraised As-is Value

The third common mistake we see is when a platform bases their initial distribution on the as-is value of the property which is greater than the actual purchase price.

Using the same example as above, let’s assume the borrower bought the property for $100,000 but the appraisal gives it an as-is value of $150,000. This happens often as many borrowers are really good at buying below market value. If distributions are set properly, this is typically a good thing for you because there is additional equity.

What you have to watch out for is a platform that distributes proceeds based on 80% of the $150,000 valuation, in this case $120,000 on initial distribution. If this is done, it means $100,000 goes to the seller and $20,000 goes into the pocket of the borrower.

By now you will recognize that this shouldn’t be done. If a platform is lending on a percentage of the as-is value which is greater than the purchase price, the borrower will have negative equity. What’s the incentive to complete the project?

Key Takeaway – A higher appraised as-is value is generally a good thing as it gives you additional equity protection at first distribution. It can backfire quickly if the platform underwrites and distributes funds at closing that doesn’t require any borrower equity – or worse puts money in their pocket. Don’t fall for this one.

There are many other things which you should consider before investing which are briefly highlighted below. We do however believe the consideration for “Aligned Incentives” is the MOST IMPORTANT and one that is easily missed when only looking at Loan-to-Value or ARV.

Other Underwriting Considerations:

-

Experience – Does the borrower have enough experience. Do they know their market? Do they have a team of qualified professionals? Have they done enough projects to know how to manage challenges? We require at least 2 projects in the last 12 months, with consideration given to other relevant experience, credit, liquidity. This ensures enough experience, knowledge of market and ability to handle unforeseen challenges which may arise.

-

Credit Score – We check credit on all borrowers. While we’re largely underwriting the value of the asset, we look for patterns of responsible financial behavior.

-

Market – We focus on tier 1 and 2 suburbs of cities that have strong employment. The house needs a buyer once it’s complete and being in the right market is important for this. How are the schools? What are the crime statistics? Are there other houses actively trading within a 2-5 mile radius?

-

Scope of Work – We pay close attention to the scope of work to determine whether the developer is creating a home that is “in market”. Sometimes granite and stainless steel is required. Other times it may cause the house to be over priced which won’t allow for the value to be realized.

There is a lot that goes into properly underwriting these types of loans. Partnering with a good platform will help take some of the burden off of you.

For more, check out the funded projects on our platform at https://www.upright.us/invest/investment-opportunities and tell us what you think at invest@upright.us.