The Horizon team is pleased to present an updated fund overview for mid-December.

Horizon Fund Capital Overview

In the past 60 days, the Fund has seen continued progress across all aspects of its portfolio. The Fund has raised new equity totaling $256K, bringing the Fund’s total equity commitment to $24.19M. The team has also reviewed and approved 53 new construction draws and disbursed ~$2.13M to developers for newly completed work. As of December 16th, the Fund holds a remaining construction draw liability of $5.17M, which will be funded through the combination of equity and levered capital from our senior partner. Additionally, the Fund has repaid $11.46M of levered capital over the same period, bringing its total levered capital to $6.70M. With limited new investment opportunities over the past couple of months, the Fund’s Manager and Investment Committee have found that it is in the Fund’s best interest to continue to pay down its senior financing line. Based on recent loan payoffs, we are anticipating that this balance should be nearing $5M by the end of January, if not sooner. Additionally, this reduction in levered capital has reduced the Fund’s interest expense by ~$40K since the end of October. With the Fund’s senior partner dropping the 1% oversight fee for all of 24Q4, along with a reduction in interest expense, we anticipate investors should see positive impacts to returns to end 2024. The Fund’s Manager, along with the Servicing team, will remain focused on loan performance to end the year, and our Investment Committee continues to explore opportunities to purchase new loans as we head into 2025.

Below is the monthly breakdown of the Fund’s total equity, loan balances, and levered capital.

Portfolio Composition & Risk Management

When looking at portfolio composition and risk management for Horizon, a few of the main portfolio metrics the Horizon team considers are geographic location, weighted average leverage metrics, and project type. We underwrite and monitor these different metrics to ensure we are maintaining a balanced portfolio that aligns with our overall investment strategies.

As of mid-December, the portfolio's top markets were North Carolina (26.50%), Florida (23.77%), and South Carolina (8.98%). Below you will find visuals to display Horizon’s full state concentration by gross loan amount, as of 12/16/2024. As the Fund has not purchased any new loans since the end of September, recent geographic shifts in the portfolio are strictly due to loan repayments, with 33 loans fully repaid in the last 60 days. Currently, 33% of all projects in the Fund’s portfolio are 100% complete, and an additional 24% are 90%+ complete. While the Fund will be limited in its ability to purchase new loans over the next few months, we could still see concentration shifts as loans continue to repay.

Horizon State Exposure – % of Total Portfolio as of 12/16/2024

| North Carolina. . . . . . . . . . 26.50% | Alabama . . . . . . . . . . . . 5.76% |

| Florida. . . . . . . . . . . . . . . . . . 23.77% | Maryland. . . . . . . . . . . .2.45% |

| South Carolina. . . . . . . . . . . .8.98% | Pennsylvania . . . . . . . 2.10% |

| Ohio . . . . . . . . . . . . . . . . . . . . . . 8.94% | Georgia . . . . . . . . . . . . . 2.10% |

| Texas . . . . . . . . . . . . . . . . . . . . 8.04% | Other . . . . . . . . . . . . . . . 5.01% |

| Indiana . . . . . . . . . . . . . . . . . . . 6.35% |

Horizon’s loan leverage metrics are also a vital piece to the portfolio’s overall health. These leverage ratios are what protect each loan against any potential downside risk. Below is a breakdown of each metric:

- Loan to As-Is Value (LTAIV): We have set a maximum LTAIV constraint per loan of 70%, and are targeting a portfolio below 65% LTAIV.

- Loan to Cost (LTC): We have set a maximum LTC constraint for any loan within the portfolio at 90%, while targeting a weighted portfolio makeup below 85%.

- Loan to After Repair Value (LTARV): The Horizon team has set a 70% maximum LTARV constraint for each loan and for the entire portfolio.

In the below table, Horizon’s month-over-month changes in WAVG loan leverage metrics are presented. All three portfolio metrics have remained at or below their target mark through mid-December.

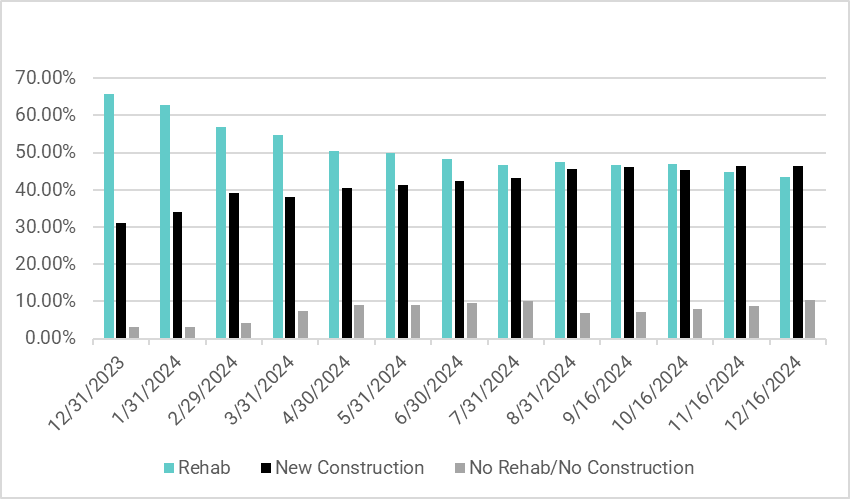

Additional Horizon Portfolio Composition

Project Type – % of Total Book (12/16/2024)

Loan Performance & Delinquencies

Delinquency management is a core focus at Upright, beginning with rigorous underwriting practices and supported by our Servicing and Asset Management teams, who employ industry-leading strategies for effective recovery. These strategies include relationship-based borrower management, timely issuance of Notices of Default, and loss mitigation evaluations after 61 days of delinquency. Given the short-term nature of our asset class, understanding delinquency rates is crucial, as performing loans typically repay within 10 months on average, while delinquent loans may require longer resolution periods.

As we have progressed through 24Q4, the Fund has experienced an increase in its overall delinquency rate, shifting from ~26% in mid-October to ~42% in mid-December. This uptick in delinquency, however, is not solely indicative of deteriorating overall loan performance, but rather a reduction of total loans outstanding. In the past 90 days, the Fund’s loan portfolio has shrunk from 153 loans outstanding to a current portfolio size of 113. In this same period, the total number of loans that are delinquent has only increased slightly, moving from 40 in mid-September to 43 as of mid-December. The Fund’s increase in total delinquency rate reflects the repayment of performing loans and the reduction of the Fund’s outstanding principal balance, which our delinquency rates are calculated on. This increase in the overall delinquency rate is generally expected when new assets are not added.

Looking at the Fund’s current delinquencies, the team managed 7 loans in the 31-90 day delinquency buckets, with Notices of Default issued promptly for loans exceeding 60 days delinquent. The team's continuous efforts kept the total number of loans in this bucket relatively low through mid-November, with 10 loans in the 31-90 bucket, and were able to hold this at 10 total loans through mid-December.

Loans in the 91+ bucket also did not shift significantly throughout the past 60 days. As of 10/16, the Fund held 32 loans in this bucket, which increased to 33 loans, as of 12/16. To begin December, four loans were progressing through foreclosure. On December 3rd, one of the loans in foreclosure was sold back to Horizon at auction and we are awaiting the deed transfer to take this property into REO. We are expecting to have the deed transferred to Horizon in the coming week and once finalized, we will immediately begin exploring options to list this property for sale. Additionally, our team is pursuing foreclosure on five new loans. Four of the five properties have already completed 100% of construction and we are hopeful that our foreclosure notice will move the borrower to find an exit for the properties quickly. For the remaining loans 91+, our Asset Management team continues to explore foreclosure and workout options for all 91+ delinquencies, ensuring that we pursue the best possible outcomes. Currently, we have payoff demands out to borrowers for five loans that are 91+ and are hopeful that these may repay before the end of the year.

Below is a chart displaying the Fund's delinquency rates over the past 90 days, presenting both the total count and the percentage of the active book based on the Unpaid Principal Balance of delinquent loans. This detailed transparency reflects our commitment to rigorous reporting standards and aligns with the MBA’s approach, while also providing an expanded view of our delinquency performance.

Horizon Residential Income Fund I, LLC

Thank you for your continued trust and support in Horizon Residential Income Fund I, LLC. We welcome all questions and suggestions and look forward to a successful and rewarding journey together.

Sincerely,

Matthew Rodak

Chief Executive Officer