Since day one, we've been dedicated to industry-leading transparency into our business processes and performance. A few new things in case you've missed them:

- We released the latest investor report on the 3Q23 performance of the Horizon Residential Income Fund I, LLC (HRIF). Read the report here.

- Upright was named to the 2023 Deloitte Fast 500 list, ranked at #246 for 570% growth in the past three years.

- The 10-year Treasury yield fell below 5%. Get other key CPI updates and read our thoughts on what this means for the housing market.

December Investment Details

In the month of December we saw:

- $24,352,500 in new investments across all retail investment offerings (Borrower-Dependent Notes (BDN), PFNF, RBNF) at a WAVG rate of 11.16%.

- $1,020,500 Horizon Fund investments

- $17,000,000 BDN investments

- $6,332,000 series note investments

- 1,468 total investments

- Total of $3,063,212 paid to investors in actual income, including:

- $2,938,331 in interest

- $7,436 in late fees

- $117,293 in extension fees

Our accredited investors continue to invest in projects ranging from zero to 100% complete, in all of the 36 states in which we conduct business, split between new construction, rehab and bridge loans. Those investments into Horizon Fund are amplified through a conservative use of leverage that has allowed the Horizon portfolio to purchase $47mm in gross loan amount. Conscientiously focused on diversification, the fund ended 2023 with just 3 of 174 loans late on payments. We are excited to release the Q4 Quarterly Investor Report in mid-February and are in discussions to raise the size of the fund due to its increasing demand.

December's Performance

In December, we originated 162 loans, totaling more than $49 million in origination volume.

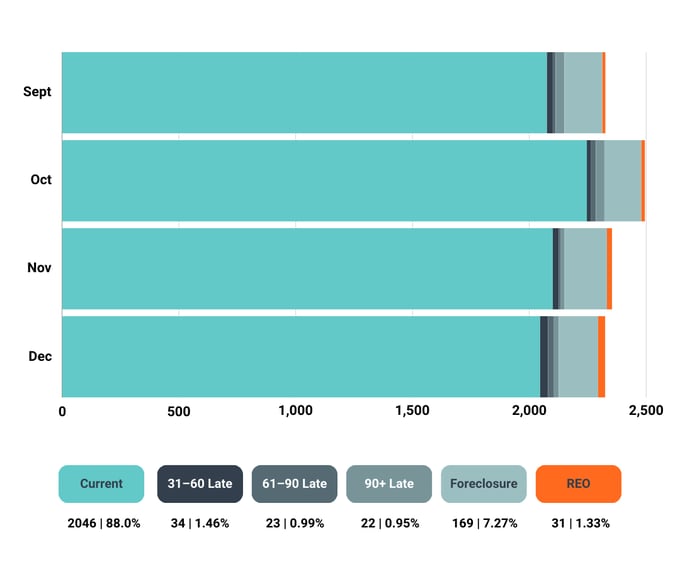

As of December 1, 12% of our total loan count was 31 days or more late on payments.

Delinquency is a nagging injury, not a chronic illness.

Diligent efforts by our Asset Management team in loss mitigation and foreclosure have resulted in a commendable reduction of over 2% in the delinquency rate since its high in July, 2023. Current delinquencies are $7mm below July numbers. The current delinquency percentage is based upon a reduced book size; due to the short-term nature of our loans and a shrunken market in 2023.

Notably, loans originated since July 2022 exhibit a remarkably low delinquency rate of just 1.2%, underscoring the high performance of recent originations. Nearly half of our delinquencies stem from loans originated before 2022, with 83% occurring before July 2022.

Looking ahead, the landscape is evolving favorably, with cooling inflationary pressure bringing interest rates to more reasonable levels and properties spending an average of 36 days on the market. Home prices in most markets are climbing back to or exceeding mid-2022 levels, aligning with our thesis of a housing supply shortage that experts have recently placed as high as 4 million units nationally. We have also instituted incentivized ACH enrollment, and continue operating our incredibly successful restructured servicing teams. These positive changes are contributing to more successful resolutions with delinquent developers, reducing the incidence of defaults.

While there is uncertainty around when repayment may occur, we proudly boast a principal recovery rate of over 99.7% since inception

How We Present Our Data

As you can see in the charts above, we show you the total count (rather than $ amount) of delinquent loans. This is to remain transparent on our business performance, but also to better align with the Mortgage Bankers Association's (MBA) standard, published in its National Delinquency Survey (NDS), which is based on loan count. However, the MBA classifies delinquency as loans that are 60+ days late on payments. We show you the count of delinquent loans from 31+ days to again, remain transparent.

The NDS states:

The delinquency rates and foreclosure starts rate are seasonally adjusted to account for trends in the data that are caused by the time of the year. For example, delinquencies tend to increase from the first to fourth quarters, peaking in the fourth quarter, before falling in the first quarter of the next year and beginning the cycle again."

The delinquency rates and foreclosure starts rate are seasonally adjusted to account for trends in the data that are caused by the time of the year. For example, delinquencies tend to increase from the first to fourth quarters, peaking in the fourth quarter, before falling in the first quarter of the next year and beginning the cycle again."

The data we share in our Performance Reports is not seasonally adjusted, but we feel it's pertinent to explain seasonal trends when applicable.

More Insight into Delinquencies

The management of delinquencies at Upright remains a top priority, with our Servicing and Asset Management teams employing best-in-class practices to ensure both expeditious and maximum recovery. These practices encompass relationship-based borrower management, swift Notice-of-Default issuance, and work-out evaluation by our loss mitigation team once a borrower is 60 days delinquent. Additionally, Upright is continuing to enhance our proprietary foreclosure and loss mitigation management system, to ultimately provide real-time loss mitigation and foreclosure updates to investors.

It is essential to note that the short-term nature of our asset class necessitates a nuanced understanding of delinquency rates. While performing loans are typically repaid within an average of 10 months from origination, delinquent loans often require a more extended resolution period. Subject to the county court systems, Foreclosures have seen an average national timeline approaching three years, with most of the states in which we operate averaging close to two years.

The past few tumultuous years have further complicated the situation as many borrowers entered into default as a function of optimizing when and at what price point their active projects should be brought to market. Many investors leverage seasonal buying trends before selling a property: refinancing it based on comparable sales that support higher value or at lower rates, or leveraging the sale or refinance of another property to sustain payments and project development. As an asset-based lender, we strive to balance being sensitive to the challenges our developers face to help foster the completion and successful exit of their active projects while also progressing towards the ability to foreclose to recoup investor principal as quickly as possible. If you have any questions or would like to provide feedback, email us at ir@upright.us. We will respond as soon as possible.

Log in to your account to browse all of our open offerings, including the Horizon Residential Income Fund.