In the first installments of A Guide to Investing with Fund That Flip, we explored the basics of real estate crowdfunding, how active investing is different from passive investing, and whether or not real estate investing is right for your investment portfolio. (See our previous articles: Investing in Real Estate Online 101, Investing in Real Estate Online 201, and Is Investing in Real Estate Online Right for Me?) Now that you've made the choice to invest in real estate online, let's look at why Fund That Flip is a great solution for many investors looking to make attractive returns.

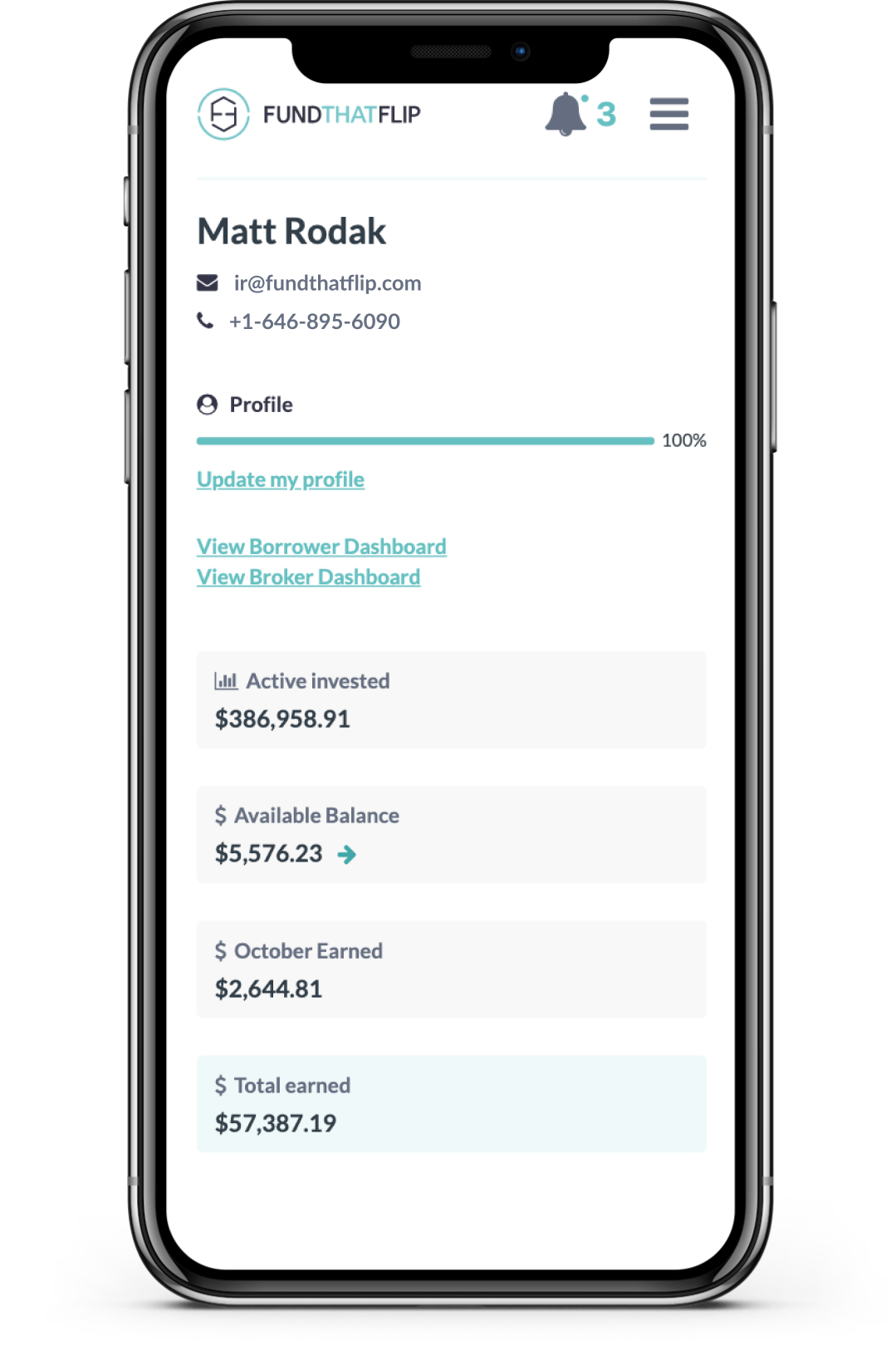

Launched in 2014, Fund That Flip is a leading peer-to-peer real estate lending platform, providing short-term (3-18 months) loans (up to $5 million) to experienced real estate redevelopers who buy and renovate residential properties. After origination, Fund That Flip offers accredited and institutional investors the opportunity to purchase fractional shares of the loan and earn as high as 12% annualized yield. To date, Fund That Flip has originated over 1,500 loans for nearly half a billion dollars.

Since 2014, Fund That Flip has received numerous recognitions. Most notably, Fund That Flip was named to the Inc. 5000 Fastest Growing Companies in back-to-back years, ranking at #42 in 2019 and #647 in 2020. Other accolades include The Financial Times’ #17 Fastest Growing Company of 2020 and LendIt Fintech Emerging Real Estate Platform, 2017. Our Founder and CEO, Matt Rodak has also picked up a few awards as one of The Financial Technology Report’s Top 50 Financial Technology CEOs of 2020 and one of The Startup Weekly’s Founders to Watch of 2019.

A main reason why Fund That Flip has been able to achieve so much success in just a few years is that before we were lenders, we were house flippers ourselves. Because of our expertise, we have been tapped for Forbes Real Estate Council and also, mentioned by other writers of Forbes. For third-party, comprehensive reviews of Fund That Flip, click to read what Motley Fool’s Millionacres, YieldTalk, and The Real-Estate Crowdfunding Review have to say about investing on our platform. And to date, we’ve paid out millions to our accredited investors. On average, investors have earned an annualized return over 10.75% with principal repayment in under 10 months. But don’t take our word for it. See what actual investors are saying about us:

"Fund That Flip deserves credit for how transparent they are on displaying activity on prior investments, including detailed updates from projects that underperformed."

- Comment on YieldTalk

"I've invested for over a year and a half with FTF, and continue to do so despite COVID. I appreciate the transparency they provide both on individual opportunities, but also with regular updates on active investments. Customer service is very responsive. No complaints so far."

- Comment on MoneyMade

"I've done over 50 deals on Fund That Flip as a lender. I'm impressed with the vetting of deals and the high quality of their management team. Their website is very easy to use and filled with valuable data that borrowers and lenders demand."

- John L.

Ready to add real estate to your portfolio? Get started by creating a free account today: